Featured Market Data

Yield Curve Signals

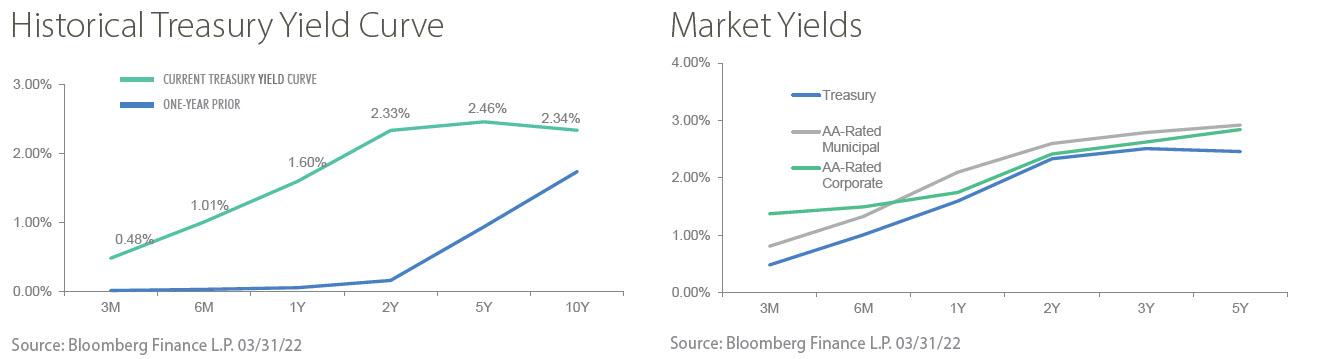

The yield on 10-year Treasuries briefly dipped below 2-year Treasuries on Tuesday, March 29. When this inversion of the yield curve occurs for a sustained period of time, a recession has consistently followed in the next two years. This part of the yield curve has been a good signal of recessions because 2-year Treasury yields reflect fed funds rate expectations, and the 10-year moves with growth and inflation expectations. In the past, Fed rate hikes have reduced consumer spending and business activity, resulting in lower 10-year yields and eventually a recession. Mixed signals from the bond market suggest “this time might be different.” The Fed ended its $120 billion per month bond buying program in March and 10-year Treasury yields have risen.

Source: Bloomberg, Financial Times

Recent News

Booming Employment

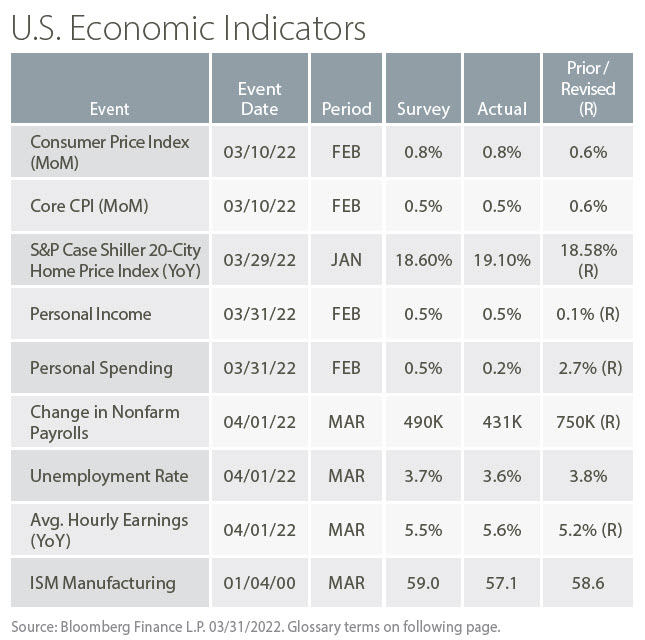

The U.S. economy added 431,000 jobs in March as workers returned to the labor force and unemployment declined to 3.6%. The March report marked the 11th straight month of job gains above 400,000. The unemployment rate is near the pre-pandemic rate of 3.5%, which was a 50-year low. Booming employment has pushed hourly earnings up 5.6% over the past year. The tight labor market offers the Fed room to hike rates.

Source: Wall Street Journal