Featured Market Data

Like a Lion

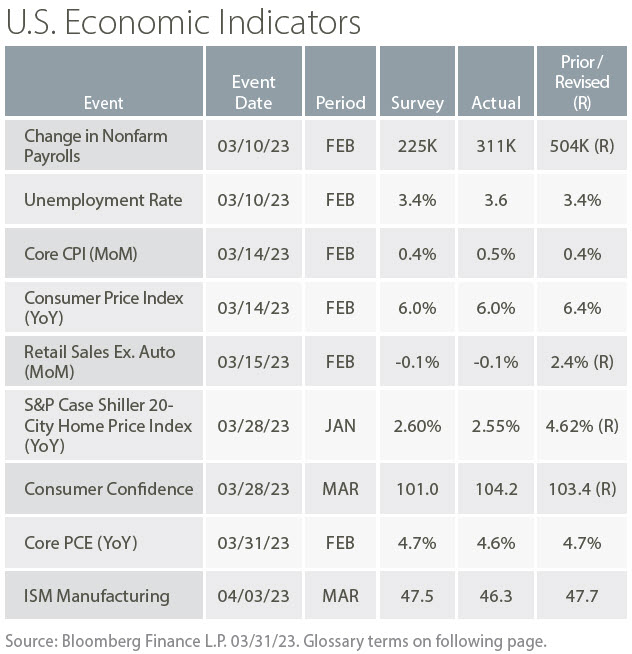

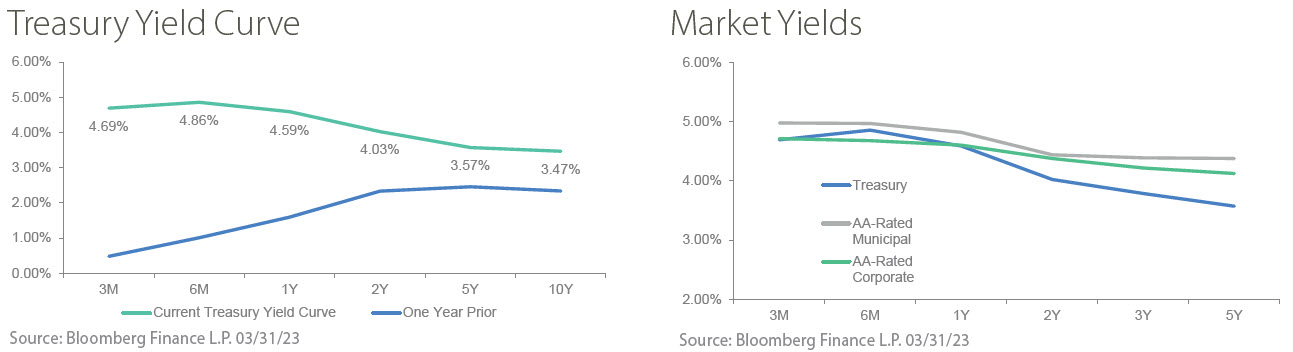

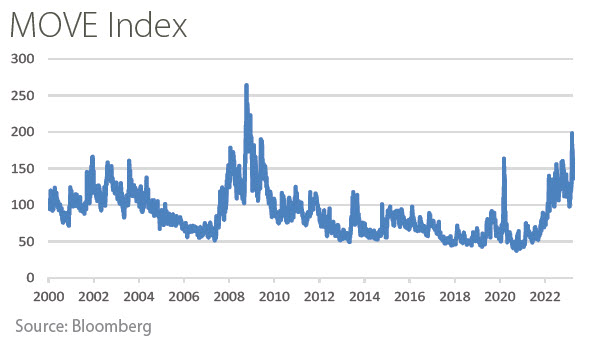

The rates market roared in March as Treasury yields rose and fell sharply in response to economic data and market developments. The 2-year Treasury yield began the month near 4.8%, climbed to over 5% and dipped below 4% during the month. March began with focus on Fed Chair Powell’s congressional testimony indicating the potential for faster rate hikes if employment and CPI data remained strong. Rates then moved sharply lower due to rapidly evolving stress in the banking sector. With uncertainty high and economic data mixed, the Fed opted for a 25 basis point rate hike and softened their language about possible future hikes. March’s moves are a reflection of the continued volatility and bumpy landing we have been expecting for 2023.

Source: Bloomberg

Recent News

Tech Supports S&P 500 Rally

The S&P 500 rose more than 3.5% in March despite banking sector developments and bond market volatility. Tech stocks led the way, with the S&P 500’s tech sector climbing 8% since March 8th. A decline in interest rates is widely credited as supporting higher prices for the sector. The rally lacked breadth, however. On March 31, 45% of S&P 500 stocks closed below their 200-day moving average. More economically sensitive sectors were down as recession fears grew during the month.

Source: Wall Street Journal, FactSet