Featured Market Data

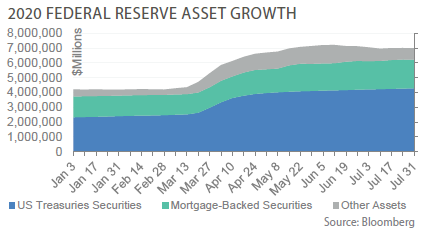

Massive Purchases by Federal Reserve

Following a period of extreme market stress in March, the Federal Reserve reopened and created several programs aimed at boosting liquidity across a range of markets. In support of these programs, the Federal Reserve boosted its balance sheet by $2.8 trillion to nearly $7 trillion through July 31st. These massive purchases have supported bond and equity prices, while reducing bond yields. Purchases of U.S. Treasuries and mortgage-backed securities have together totaled nearly $2.5 trillion in 2020. Other asset growth has included loans from the Paycheck Protection Program of $70 billion, the Corporate Credit Facility of $44 billion, the Main Street Lending Program of $38 billion and the Municipal Liquidity Facility of $16 billion.

Source: Bloomberg, PMA Asset Management

Recent News

Stock Prices Continue to Rise

U.S. stock prices as measured by the S&P 500 have fully recovered from the March sell-off . The S&P 500 was up 1.25% year-to-date through July 31st. This tremendous recovery has occurred during a period of falling corporate earnings and record low GDP of -32.9% in the 2nd quarter. Markets are forward looking and focused on the recovery; however, we believe the market’s large divergence from fundamentals suggests fi scal and monetary stimulus have been large drivers of price growth. Another observation is that the recovery has been quite shallow with only 38% of companies, mostly technology-related, showing positive price growth for the year.

Source: Bloomberg, FactSet, PMA Asset Management