Featured Market Data

Rates Fluctuate on Divergent Data

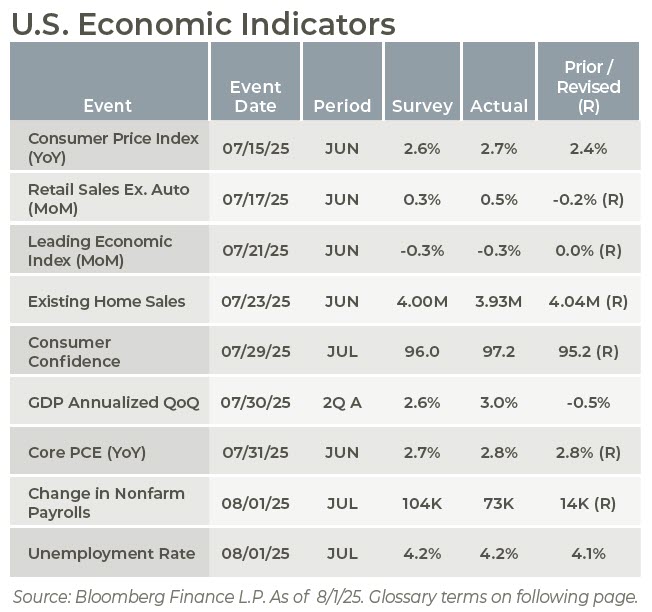

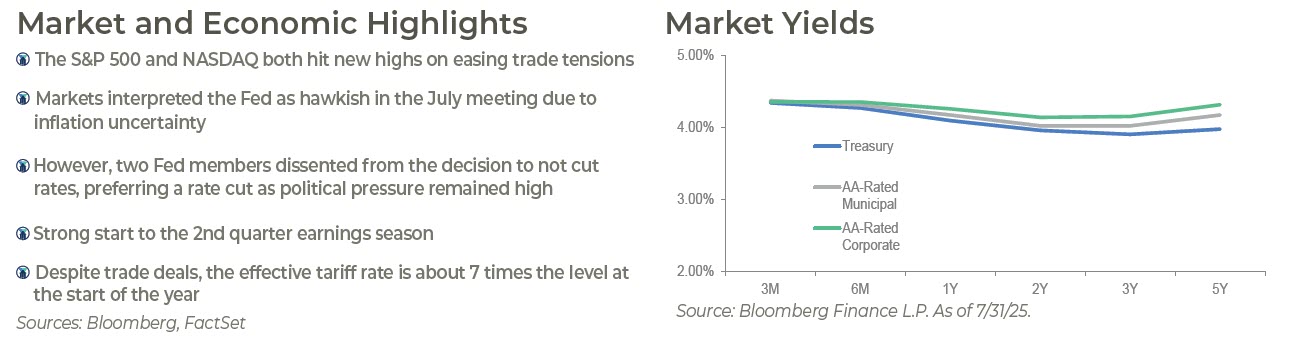

The 2-year U.S. Treasury yield, a commonly used indicator of market expectations of the fed funds rate, moved higher in July. This occurred as markets pushed back expectations for Fed rate cuts. Contributors to higher yields included somewhat lower than expected Core CPI, stronger labor market data and larger growth in retail sales. This climb largely reversed on August 1st as the July employment report displayed a much weaker job picture. The U.S. economy added a smaller than expected 73,000 jobs in July. Moreover, revisions to prior reports revealed only 33,000 combined jobs added in May and June. As of August 1st, markets are almost fully pricing in a September rate cut and two total cuts in 2025.

Source: Bloomberg, FactSet; As of 8/1/25.