Investment Advisory Services Featured Market Data

Credit Market Concerns

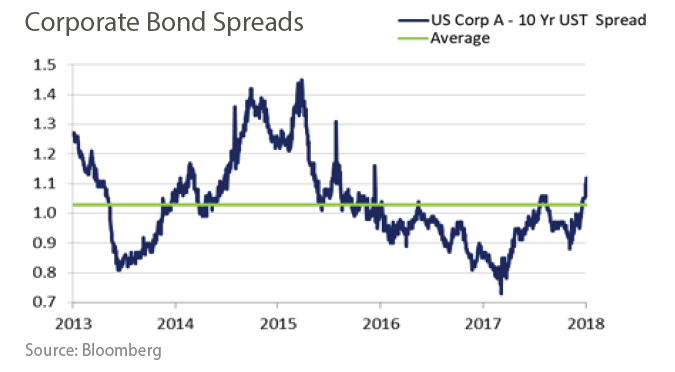

The low interest rate environment has encouraged stock buy-backs and debt issuance resulting in higher leverage ratios. As the credit cycle turns, this increased leverage could trigger concerns regarding credit quality trends.

Widening corporate bonds spreads have signaled real or perceived risk by the market. Single A rated corporate spreads over the 10 year Treasury Index hit its 5 year low of 73 bps. This spread has since widened slightly above the 5 year average of 103 bps. While the market is re-pricing risk premiums required for credit, here at PMA, we remain committed to conducting thorough due diligence and credit analysis for our clients’ portfolios.

Source: Bloomberg, Prudent Man Advisors, Inc.

Investment Advisory Services Recent News

Fed Expectation

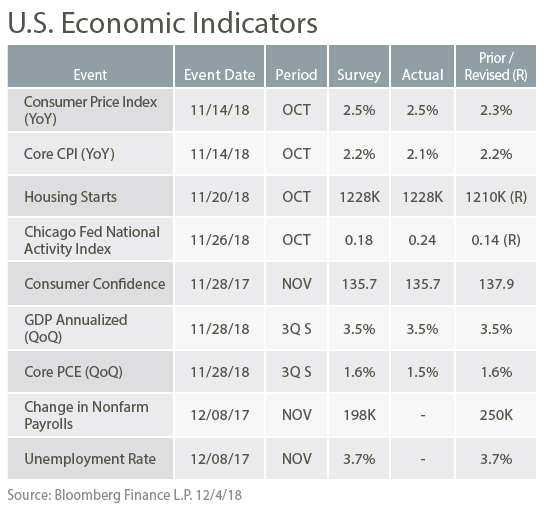

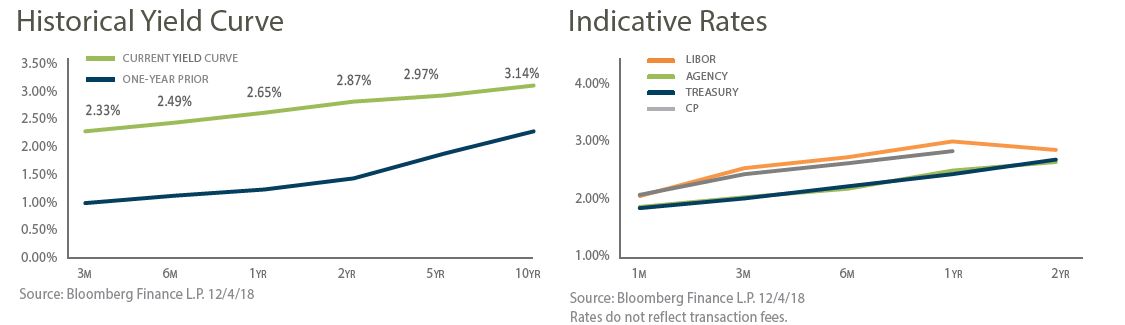

As expected, the Fed maintained its target range at 2.00-2.25% following their November 7-8th meeting. Meeting minutes show officials noted headwinds including a slowdown in global growth and softness in the housing market. In a recent speech, Fed Chair Jay Jerome said “We will be paying very close attention to what incoming economic and financial data are telling us.” We believe this statement implies that if growth slows more than expected in 2019, we should expect to see fewer rate increases than anticipated. On the contrary, if the labor market, wage and price gains remain strong, rate increases will likely continue.