Featured Market Data

Bond Market Volatility

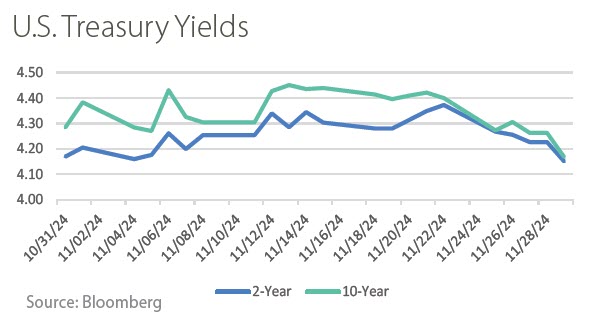

The Federal Reserve cut rates by 0.25% as expected on November 7th, yet 2-year Treasury yields began the month with a continuation of rising yields. Higher yields reflected the market’s belief that the Fed would cut rates less than previously anticipated as well as U.S. Fiscal worries. The 2-year peaked on November 22nd, 20 basis points higher than it began the month before giving back all of the increase by month-end. Volatility was also high for 10-year yields, which peaked near the middle of the month. President-elect Trump’s pick for Treasury Secretary appeared to allay markets and yields declined in the second half of the month along with inflation expectations. The 10-year Treasury finished the month 10 basis points lower than it began, with the bond market possibly signaling lower growth expectations.