Investment Advisory Services Featured Market Data

Fed Signals Potential End to Rate Hikes

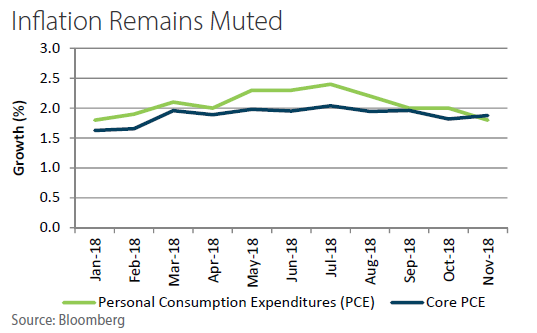

Personal Consumption Expenditures excluding food and energy (Core PCE) remains below the Fed’s target of 2.0%. The Fed’s preferred measure of inflation has risen little despite historically low unemployment levels. Headline inflation measures are also lower in line with falling energy prices. In its January meeting statment, the Fed addressed lower inflation measures and lower long-term inflation expectations. The Fed stated, “In light of…muted inflation pressures, the Committee will be patient” as it determines if future adjustments to the federal funds rate may be appropriate.

Source: Wall Street Journal, www.bea.gov, www.federalreserve.gov

Investment Advisory Services Recent News

Fed Signals Potential End to Rate Hikes

The statement released by the Fed following its January meeting eliminated a reference to “further gradual increases” in the fed funds rate. Fundamentally, this could indicate that the Fed is less concerned about rising inflation. However, the change in verbiage may also indicate that the Fed sees the economy as more fragile than previously thought. This news from the Fed follows a period of increased market volatility over which period the fed funds futures market pointed to little chance of an interest rate hike in 2019. The Fed continues to indicate that any changes to policy will be data dependent, but the new language signals the that the Fed may not increase rates in 2019.

Source: Wall Street Journal, Financial Times