Featured Market Data

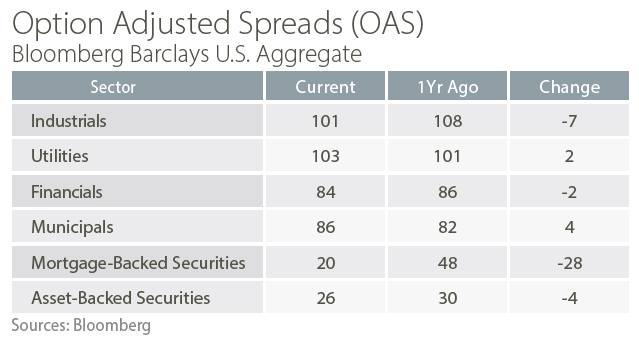

Spread Sectors Add Income

Most sectors of the fixed income market offer Option Adjusted Spreads (OAS) which aid income. OAS represents the yield of a security or sector of the market in excess of a US Treasury security with the same maturity, adjusted for any embedded option such as a call option. Investing in securities with higher spread levels generally leads to higher excess returns. This is because the higher spread generates additional income which can help offset negative price returns caused by rising rates or spread widening. While absolute yields and spreads have mostly declined over the past year, we believe thoughtful security selection will enhance total returns in 2021.

Source: Bloomberg, PMA Asset Management

Recent News

GDP Ends Year Strong

GDP grew at a solid 4% annualized rate in the 4th quarter of 2020 following over 33% growth in the 3rd quarter. The strong second half rebound wasn’t enough to offset the tremendous decline in the first half of 2020. For the full year, GDP declined 3.5% compared to 2019. Highlights in the 4th quarter were continued strength in corporate and residential housing. Consumer spending slowed to 2.5% for the quarter. Looking ahead to 2021, the Congressional Budget Office (CBO) expects GDP to grow 3.7%. The agency said the $900 billion relief bill enacted in December will add about 1.5% to the level of GDP this year and in 2022.

Source: Wall Street Journal