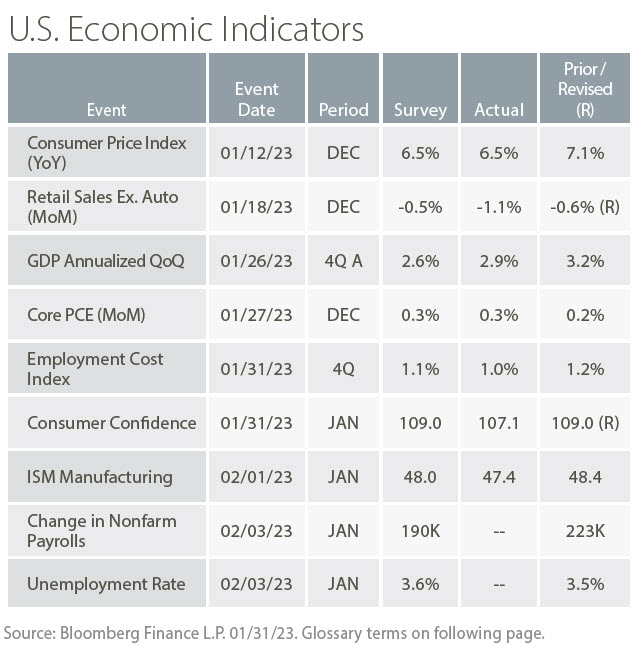

Featured Market Data

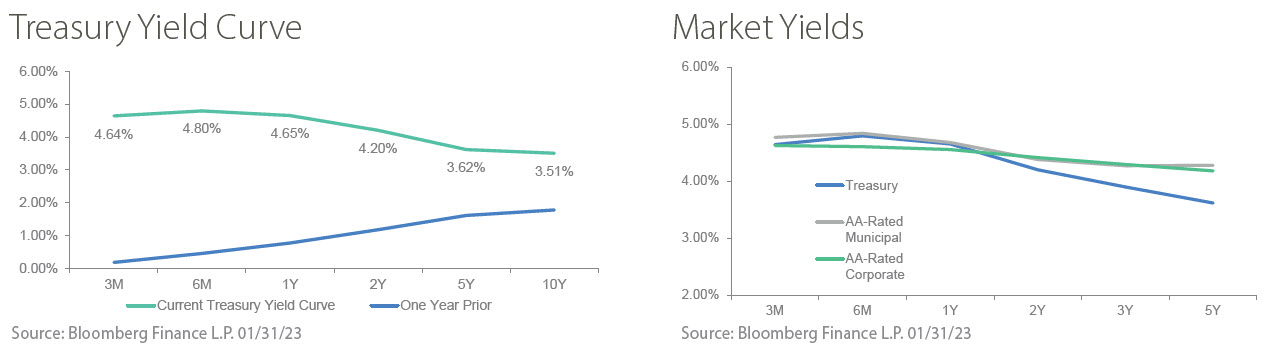

Strong Bond Returns

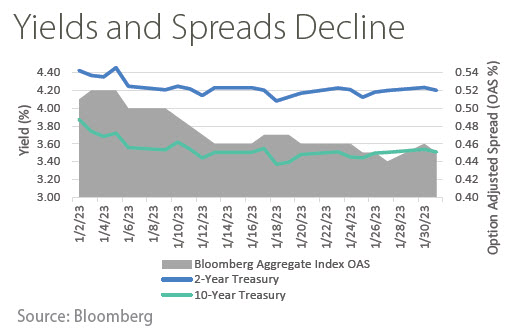

Bonds generated strong returns in January as U.S. Treasury yields declined modestly and credit spreads declined. A large spike in market yields in 2022 boosted income for bondholders, which aids returns. A move somewhat lower in yields and spreads in January also contributed to the strong monthly returns. A broad measure of bond performance, the Bloomberg U.S. Aggregate index, reported a 3.08% return for the month. The strong January performance followed a challenging year in 2022 where the bond index generated a return of -13.01%. We anticipate bonds to continue to perform well in 2023, though we see a bumpier path ahead as volatility may return to markets.

Source: Bloomberg

Recent News

Markets Heard a Dovish Fed Chair

Markets liked what they heard, and didn’t hear, from the Federal Reserve at the conclusion of its meeting on February 1. Stock and bond markets rallied during Chairman Powell’s press conference. Early reactions from market participants were focused on the Fed’s assessment that financial conditions remain tight. If the Fed was worried about recently softening financial conditions, this could lead to additional rate hikes and downward pressure on stock and bond prices. While markets seemed focused on the more dovish aspects of the Fed’s statement and the press conference, the Fed Chair continued to indicate multiple hikes are expected in 2023 and highlighted the risk in doing too little.

Source: Wall Street Journal