Featured Market Data

Economic Growth Continues

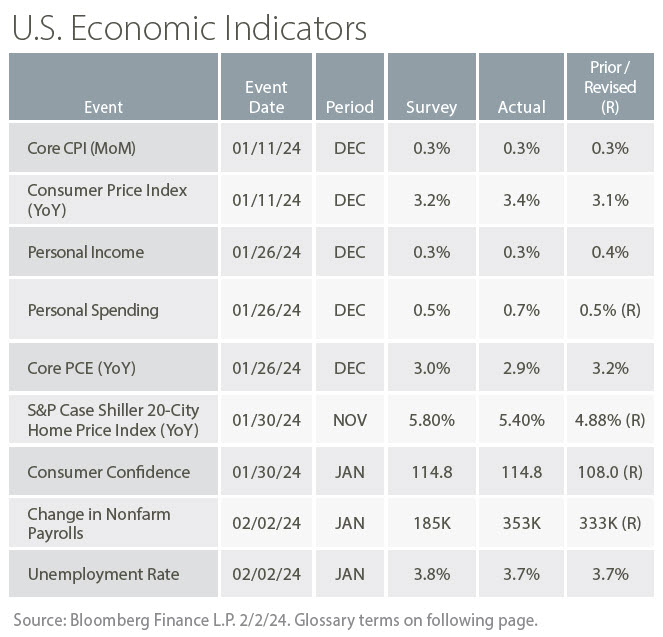

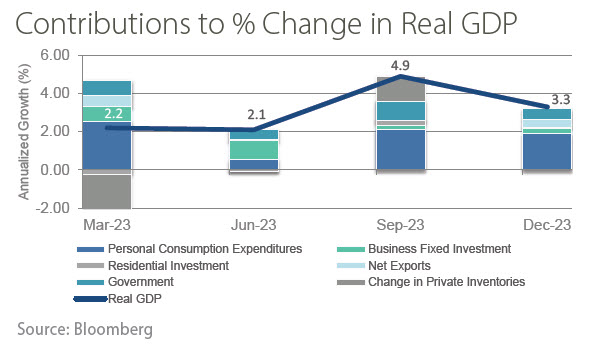

The Federal Reserve referenced the “evolving” economic outlook in a statement following its January 31st meeting in a nod to stronger growth and the potential impact on the path of interest rates. Prior to the meeting, the Bureau of Economic Analysis announced the “advance” estimate of GDP increased at an annual rate of 3.3% in the fourth quarter of 2023. While the level declined from 4.9% in the third quarter, growth remained strong and was led by 2.8% growth in consumer expenditures. Business spending accelerated to 1.9% annualized growth in the fourth quarter. Two days after the Fed meeting, markets digested a stronger than expected jobs report with 353,000 new jobs added in January.

Source: Bloomberg, www.bea.gov

Recent News

Fed Not Ready to Cut Rates

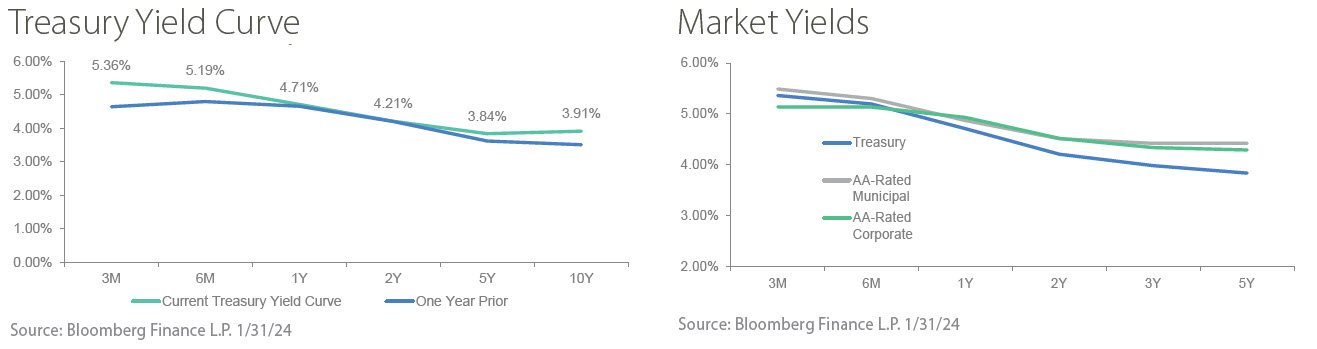

The Fed, as is so often the case, is walking a tight line in its communication. Through the Fed’s statement following its January 31st meeting, the Fed indicated it is likely done raising rates while pushing back somewhat on the timeline for when the first rate cut may occur. The Fed’s statement acknowledged progress on reducing inflation by removing language which indicated a willingness to keep raising interest rates until inflation cooled. Prior to the meeting, markets were pricing in a moderate chance of rate cuts to begin in March with about six 0.25% cuts in 2024. The Fed pushed back on this timeline by saying is does not expect cuts to begin “until it has gained greater confidence” that inflation is returning to its 2% target.

Source: www.federalreserve.gov