Investment Advisory Services Featured Market Data

Strong Consumer Spending Reflects Confidence

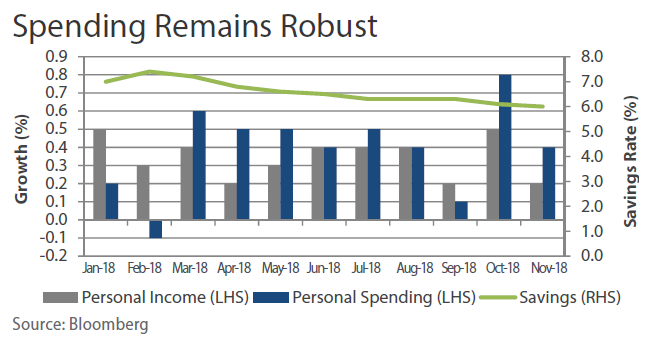

Consumer spending rose strongly in November, led by durable goods such as trucks and appliances. Consumer outlays are on pace for the best quarter of growth in four years. Growth in spending has been trending above income in 2018. This has resulted in the personal savings rate falling to 6.0%, the lowest monthly rate since March 2013. Strong spending and modest saving suggests consumers were confident in the middle of the holiday shopping season.

Source: Wall Street Journal, www.bea.gov

Investment Advisory Services Recent News

FED Signals Fewer Rate Hikes

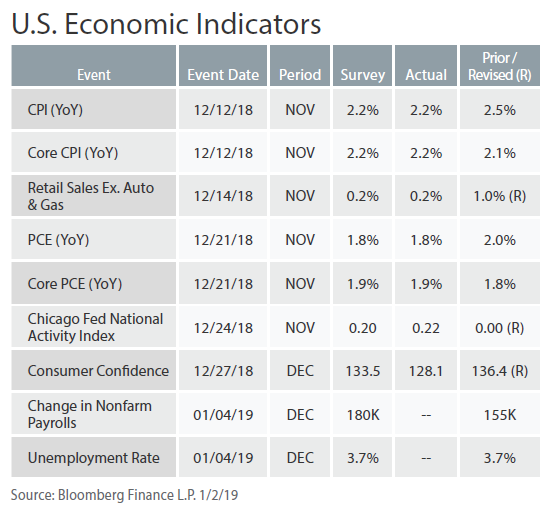

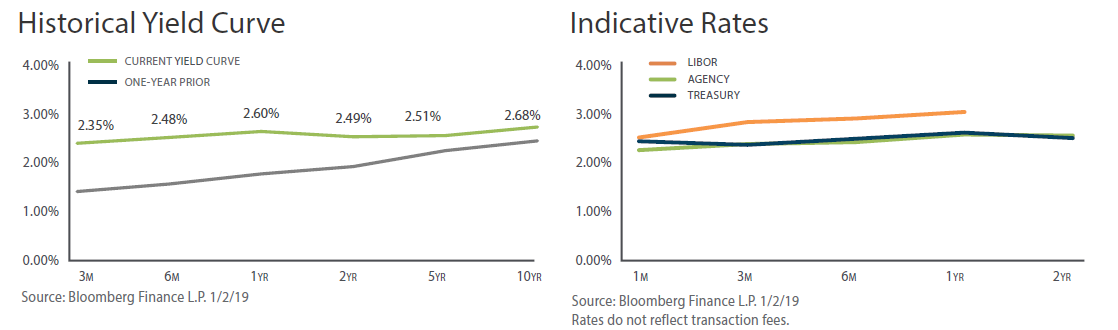

The Federal Reserve signaled it could slow the pace of rate increases in 2019 as it increased rates for the ninth time since December 2015 to a range of 2.25-2.50%. Meanwhile, Federal Reserve officials reduced the median forecast for rate increases in 2019 to two from three in the face of a slowing global economy and increased market volatility. The Fed also edged down its projection of the neutral interest rate to 2.75%. This theoretical rate, which neither boosts nor suppresses growth, has been increasingly debated by economists and market participants in recent months. Markets reacted negatively to the Fed’s announcement as markets were looking for the Fed to signal a pause in rate hikes. Days after the Fed’s announcement, Federal Reserve Bank of New York President John Williams said, “We are listening very carefully to what’s happening in the markets” and reiterated that the Fed is “data dependent and will adjust our views” based on the outlook.

Source: Wall Street Journal