Featured Market Data

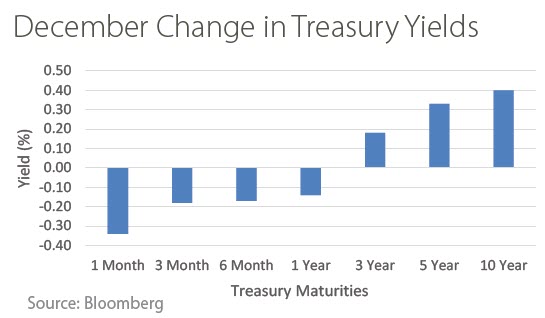

Steepening Yield Curve

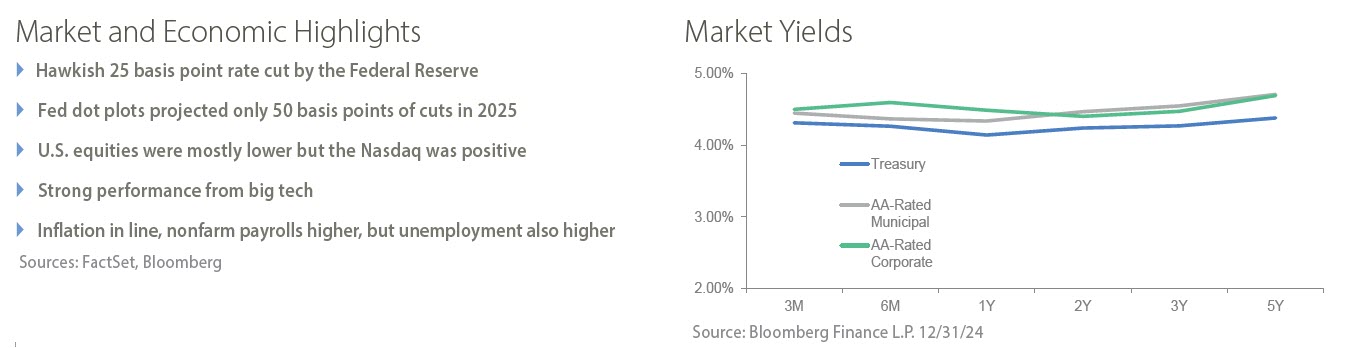

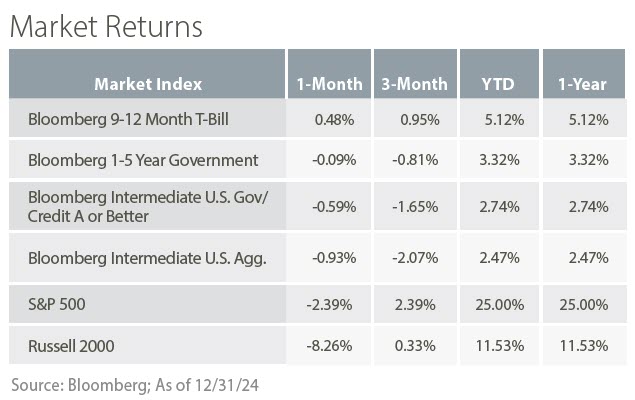

The Federal Reserve cut rates by 0.25% as expected in December to a range of 4.25-4.50%, yet longer-term yields rose for the month. The shift up in longer term yields was due in part to a hawkish tone from the Federal Reserve. In its statement following the December meeting, the Federal Open Markets Committee said it would consider the “extent and timing” of additional rate cuts. In addition, the Fed’s dot plot showed a decrease to two expected rate cuts in 2025 and a continued increase in the “longer run,” or neutral rate, of interest rates to 3.0%. These factors contributed to rising longer term rates and resulted in negative bond returns for December. Overall, a positively sloping yield curve is considered healthy for markets and the economy.

Source: Bloomberg