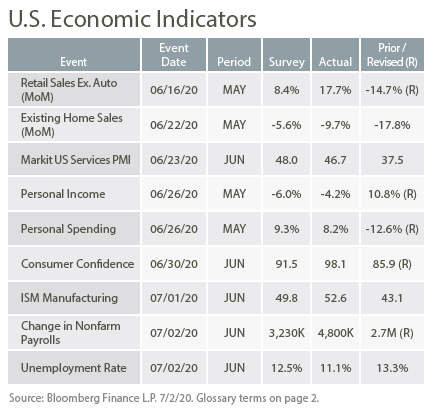

Featured Market Data

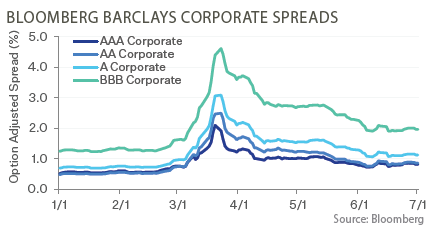

Corporate Spreads Tighten

Bond markets showed continuing signs of improvement in June as corporate spreads (the difference in yields between corporate bond indices and Treasury yields) declined for investment grade bonds. Equity and bond markets generally continued “risk on” trends as stocks and corporate bond prices rose. We continue to believe this is driven less by fundamentals than by the extraordinary stimulus measures put in place over the past two recessions. We believe fundamentals will become more important and we have seen corporate spreads inch up in the second half of June due in part to growing concerns that markets may be overvalued.

Source: Bloomberg, PMA Asset Management

Recent News

Consumer Spending Plummets

On June 16, the Federal Reserve launched a program first announced in March to buy highly rated corporate bonds in the secondary market. Fed officials have said the goal of the buying is to maintain liquidity in the market for corporate debt, so that issuers are able to access capital following a deep market disruption in March due to the pandemic. To avoid criticism that it might favor a specific industry, the Fed said it would seek to mimic a broad market index. At a Senate hearing following the program’s launch, Fed Chairman Powell was questioned about whether the purchases were still necessary, since the corporate bond market has largely recovered. Powell said the Fed had to follow through on its plan.

Source: Bloomberg, www.fortune.com