Featured Market Data

Drivers of Bond Yields

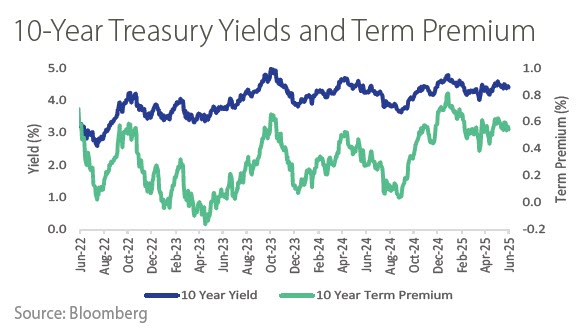

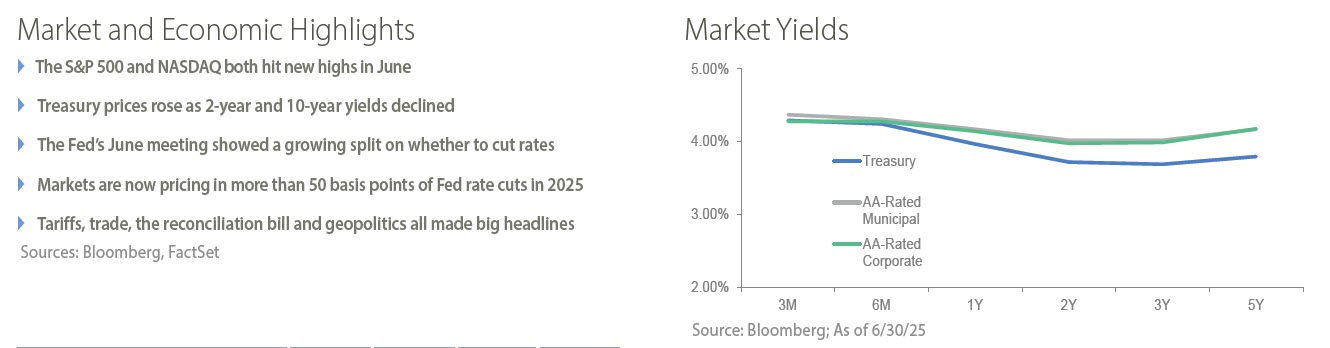

Term premium is the additional compensation investors require to hold longer-dated bonds and it is a primary driver of the upward-sloping yield curve. Treasury rates, considered the risk-free benchmark for each maturity, typically reflect the average expected federal funds rate over that period plus the term premium for bearing duration risk. In the years following the Great Financial Crisis, term premiums were persistently negative, as investors saw limited risk for higher short-term rates or inflation. However, term premiums have turned mostly positive in recent years. This shift is indicative of renewed investor focus on risks including inflation, government debt levels and dollar strength.

Source: Bloomberg, FactSet