Investment Advisory Services Featured Market Data

Personal Income & Spending Surprise to Upside

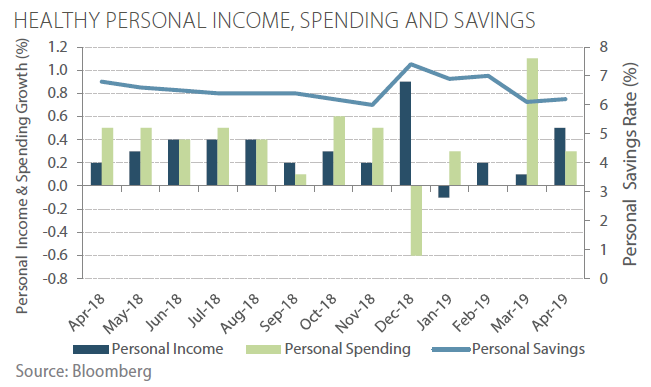

The recent Personal Income and Spending report showed that consumers, who represent over half of the U.S. economy, exceeded forecasts for income and spending in April. This healthy increase followed strong spending in March, which was the best monthly increase since 2009. Higher personal income also provided a boost to the savings rate. The strong data to start the second quarter suggests momentum may help extend an already decade long economic expansion. The current expansion will be 10 years old in June which could become the longest on record if it continues into July.

Source: Wall Street Journal, Bloomberg, Financial Times

Investment Advisory Services Recent News

Will the Fed Remain Patient?

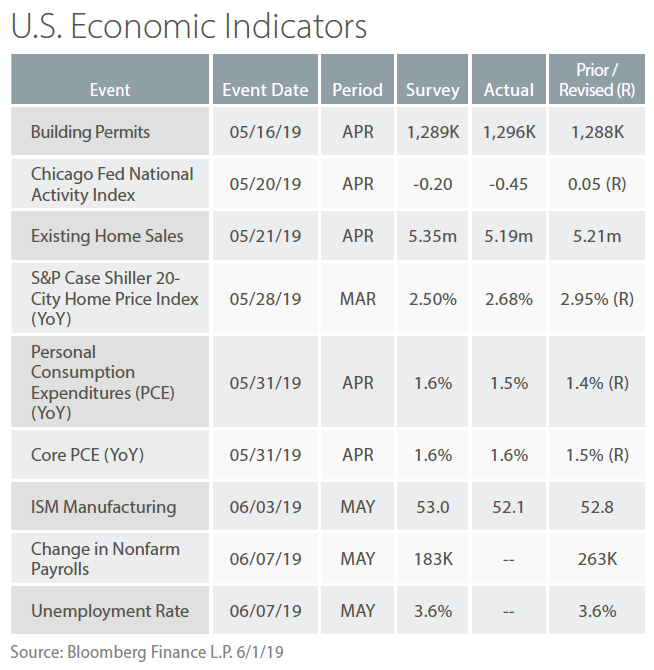

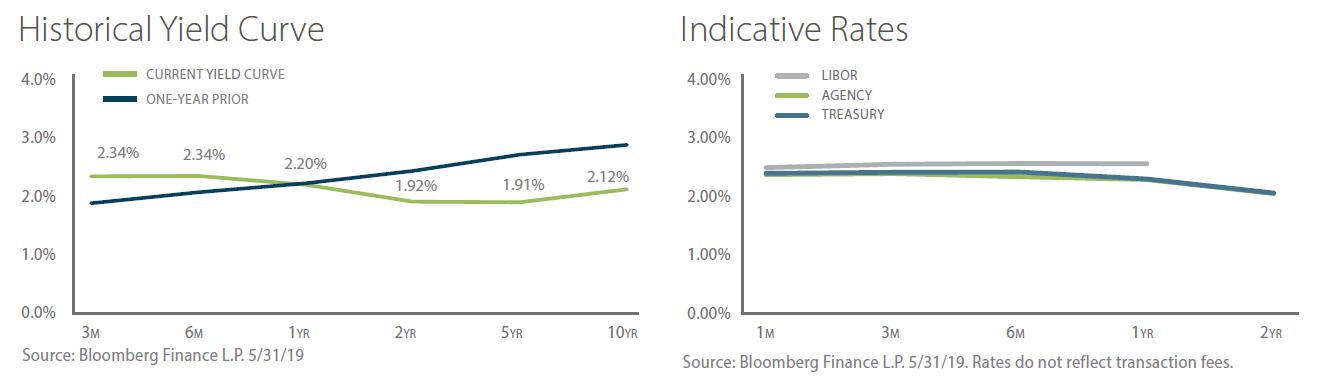

In April, the Federal Open Market Committee stated that they “will be patient” as they determine whether a change in rates is appropriate. Minutes from the April meeting indicated that Federal Reserve officials were generally comfortable with current policy and noted that a recent soft patch in inflation was viewed as temporary. Since the April meeting the U.S trade dispute with China has escalated and the prospect for new tariffs on Mexican imports was announced. These developments have influenced bond markets to price in a greater likelihood of a rate cut by September. Some economists and market participants believe the Fed will want to provide stimulus sooner since short-term rates are at a historically low range leaving little room to cut rates. Others note there is a risk to the Fed reacting too strongly creating market volatility.

Source: Wall Street Journal, Bloomberg, Financial Times