Featured Market Data

What Treasury Bonds Tell Us

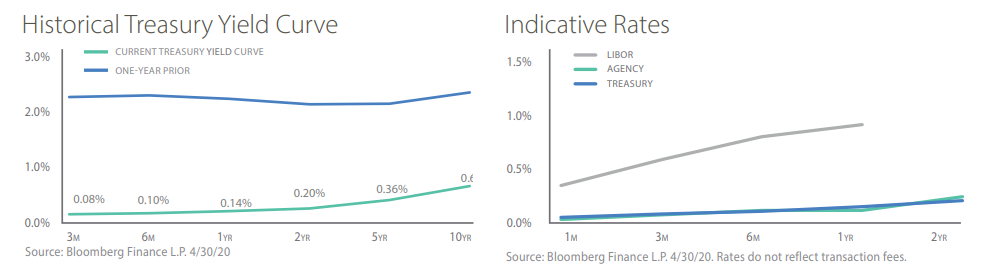

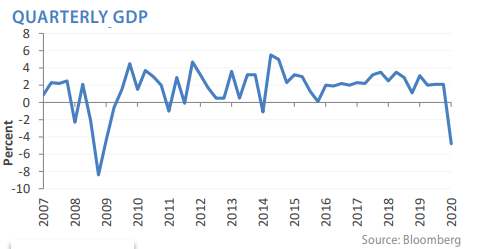

U.S. Treasury yields diverged with equities in May as stock markets soared while bond yields remained relatively stable. We believe government support may mask fundamental economic and political risks and has inflated investor optimism over the past month. On a positive note, markets are not pricing in high inflation despite growing government and central bank balance sheets. However, low Treasury yields forecast weak economic growth for years ahead. This is in stark contrast to signals from stock markets.

Source: Bloomberg, PMA Asset Management

Recent News

Consumer Spending Plummets

Consumers had little choice but to reduce spending as restrictions on non-essential activities left most Americans at home. The resulting record drop in April’s consumer spending was therefore no surprise and markets took the news in stride. The April report also showed a 10.5% spike in income related to government stimulus and unemployment insurance. To PMA, this was a stark reminder of the degree to which a record number of Americans are reliant on government safety nets as the pandemic continues. Even with states beginning to reopen in May, businesses may be slow to rehire workers. We expect this uncertainty to make people very cautious about spending for many months ahead.

Source: Wall Street Journal, PMA Asset Management