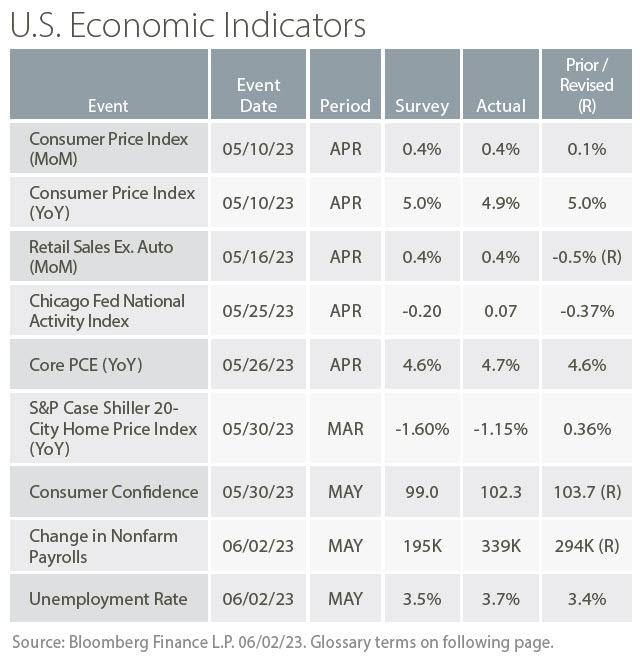

Featured Market Data

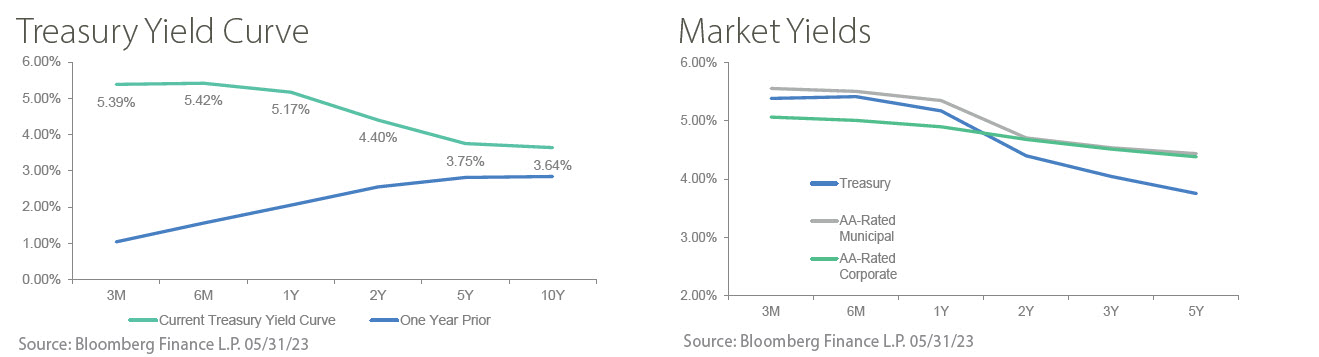

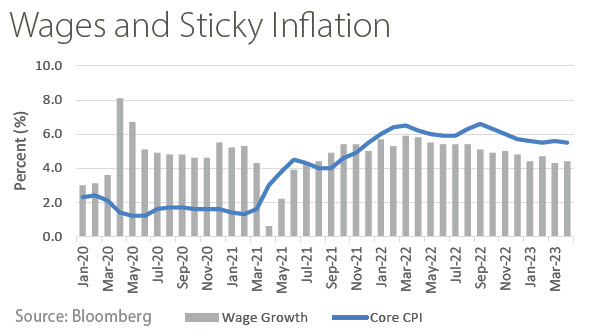

Persistent Inflation

While CPI and Core CPI have steadily declined over the past year, wage growth has remained elevated. Following a November 2022 speech by Federal Reserve Chair Powell, many economists and market participants have focused on the impact of wages on non-housing services inflation. This has been one of the “stickier” areas of inflation. In the 2022 speech, Chair Powell said, “Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.” One additional rate hike in June or July is looking increasingly likely as the Fed seeks to reduce inflation in a continued strong employment market.

Source: Bloomberg

Recent News

Deal or No Deal

Markets closely watched developments in the debt ceiling debate throughout May. During this time, many investors such as money market funds and local government investment pools avoided Treasury maturities during June. This created substantial dislocation in the Treasury Bill market as June maturities traded at much higher yields than would otherwise be expected. As of June 2, both the House and Senate passed a bill aligned with a deal struck with President Biden to avert a possible Treasury default and suspend the debt ceiling through January 1, 2025. Markets can take a breath and refocus on economic growth expectations.

Source: Wall Street Journal