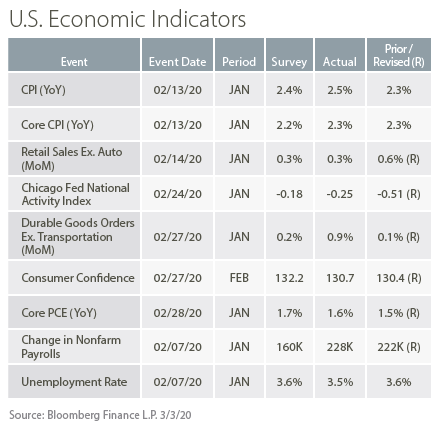

Featured Market Data

Financial Market Fallout

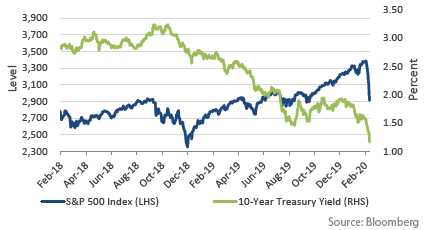

Coronavirus fears and anticipated impact on the global economy have driven large market moves. As of March 6th, the S&P 500 has declined nearly 13% from its closing price on February 19th. The flight to safe haven U.S. Treasury securities pushed yields to record lows, moving the 10-year Treasury to 0.75% as of March 6th. While the global response to the virus has been rapid, the economic impact remains unknown. Fed Chair Powell highlighted that “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. We will use our tools and act appropriately to support the economy.”

Source: Wall Street Journal, Bloomberg

Recent News

New Headwind for Manufacturing Sector

Growth slowed at U.S. manufacturing firms in February. The ISM manufacturing index fell to 50.1 in February from 50.9 in January, following five months of slowing activity. Three of the five primary components – orders, production and inventories, all declined. The weakness was attributable to the spread of the coronavirus and its impacts on supply chains. While the overall index remained in expansionary territory, it is likely that future readings will experience virus induced disruptions that will cause significant delays in production and further weakness in manufacturing activity.

Source: Bloomberg