Featured Market Data

What is Driving Yields Higher?

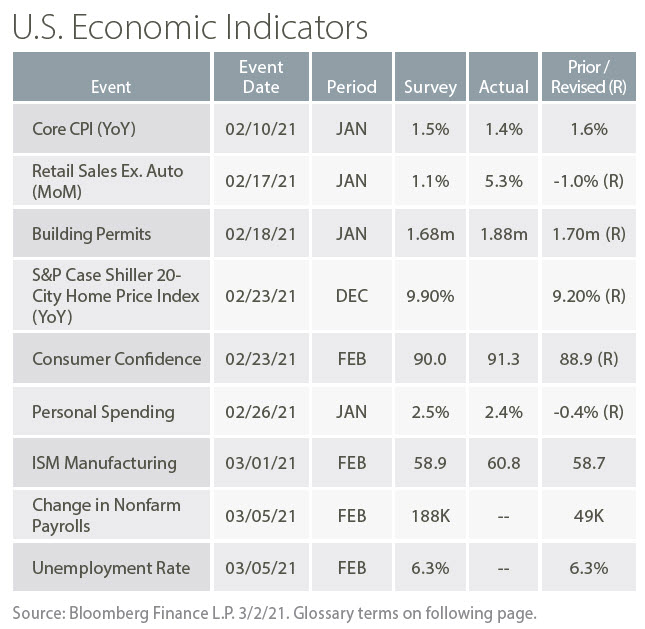

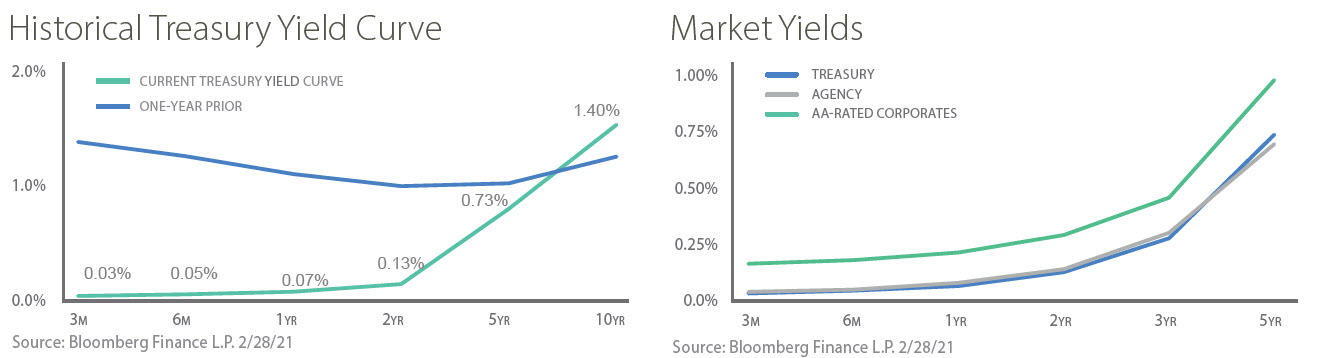

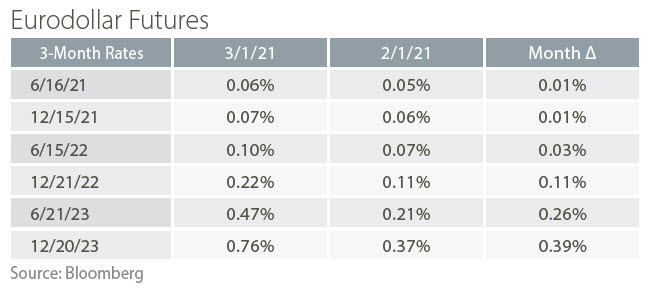

Federal Reserve officials are actively working to reassure markets that the recent climb in market yields represents improving expectations for economic growth rather than future inflation. It is clear that the rise in rates is driven by multiple factors ranging from fundamentals supporting stronger growth to technical factors such as banks hedging mortgage portfolios and increased Treasury supply. Looking beyond US Treasuries, at PMA we are watching Eurodollar futures, which are also rising. These contracts provide insight to expected Federal Reserve policy. The table below shows that the market believes the likelihood of a rate hike in 2022 or 2023 increased in the past month as market participants price in a faster recovery fueled by fiscal stimulus and dovish monetary policy.

Source: Wall Street Journal, PMA Asset Management

Recent News

Small Investors Moving Markets

As the CEOs of the trading platform Robinhood, hedge fund Citadel LLC and market-maker Citadel Securities testified to Congress in February, market professionals were also examining the impacts of January’s GameStop stock frenzy. Many hedge funds pared short selling strategies after recognizing the large impact that organized, small investors can have on the market. Others have noted tools like free trading apps and message boards can promote extreme volatility in less liquid parts of the market. While pure speculation may be driving some traders, the market is also recognizing the influence of small investors may have staying power.

Source: Wall Street Journal