Featured Market Data

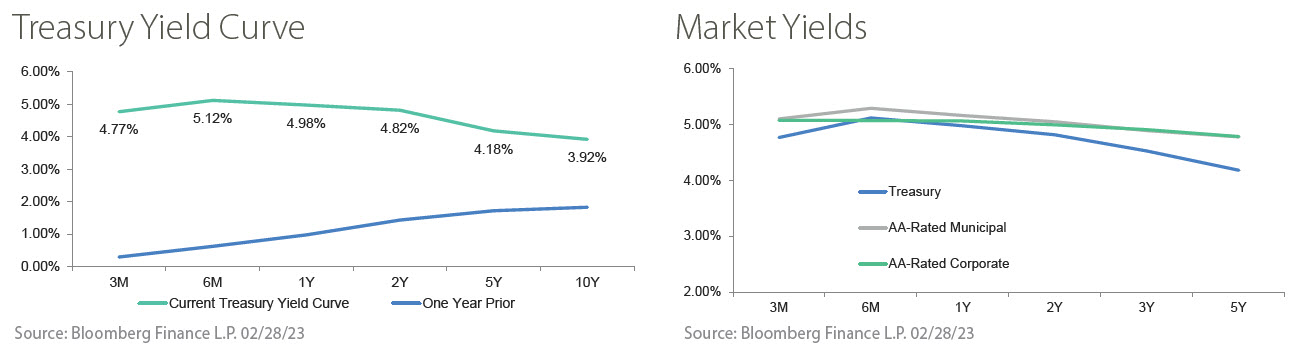

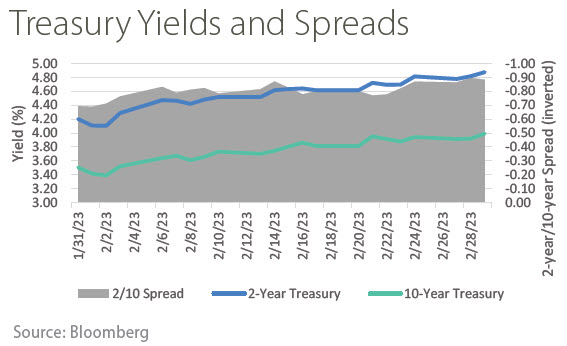

Treasury Curve Further Inverts

The Treasury curve inverted more deeply in February as 2-year Treasury yields rose 61 basis points. The increase was caused by expectations for additional rate hikes due to stronger inflation and employment reports during the month. Market expectations for the Fed’s terminal rate approached 5.4% during the month and prospects of a Fed pivot were pushed into 2024. The 10-year Treasury yield also rose, though by a smaller 41 basis points. The month ended with the 2-year / 10-year spread inverted by nearly 90 basis points. Bond prices turned negative for the month on higher rates, but higher yields and related income tempered the decline.

Source: Bloomberg

Recent News

Market Sentiment Turned Negative

The S&P 500 index fell 2.61% in February while the NASDAQ and Russell 2000 saw more modest declines. Market focus during the month was on bearish themes including earnings risk, stretched valuations, concerns about the quality of market leadership and geopolitical uncertainty. Higher inflation and interest rates also likely played a role in lower stock prices. On the earnings front, with 4th quarter earnings season nearly complete, the blended earnings growth rate for S&P 500 companies was (4.9%) at month-end, compared to (3.3%) at the end of the quarter. While 69% of reporting companies announced a positive earnings surprise, this was below the 5-year average of 77%.

Source: FactSet