Investment Advisory Services Featured Market Data

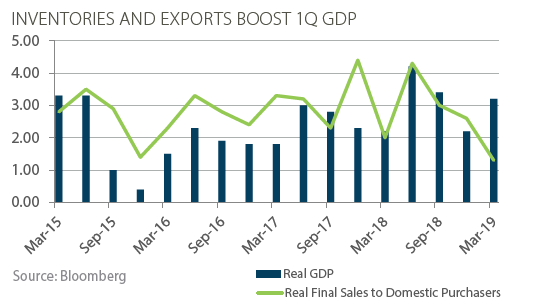

GDP May Fall From Strong Q1

Rising exports, lower imports and higher inventory offset weaker growth in consumer spending and business investments. Final sales to domestic purchasers rose only 1.3% for the quarter. This measure of domestic demand fell for the third consecutive quarter. Despite some underlying weakness, the GDP report exceeded much lower expectations from earlier this year. The report also showed that core personal consumption expenditures (PCE) rose only 1.3% in the 1st quarter. This level is well below the Fed’s target of 2%. The chance of a Fed rate cut by year-end rose to 67% following the report.

Source: Wall Street Journal, Bloomberg, Financial Times

Investment Advisory Services Recent News

Markets Rebound

The market outlook has brightened as the Federal Reserve placed rate hikes on pause; the U.S. government shutdown ended in January and both the U.S. and China have reported stronger economic data. In addition, companies in the S&P 500 index have so far reported better than expected sales and profits. Earnings growth has been positive even as estimates called for a year-over-year decrease in corporate earnings. Only the energy, materials and information technology sectors have reported negative earnings growth in the 1st quarter. The positive earnings surprises have helped push up the S&P 500 index over 17.5% through April 30. In bond markets, corporate spreads have also compressed as a sign of greater confidence by investors.

Source: Wall Street Journal, Bloomberg, Financial Times