Featured Market Data

Strong First Quarter Earnings

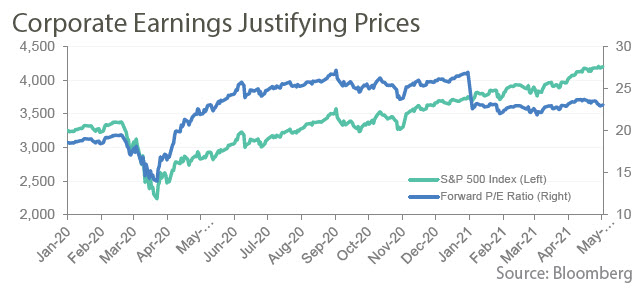

Publicly traded companies are reporting strong first quarter earnings. The fast recovery in corporate earnings is helping to justify soaring stock prices since markets bottomed in March 2020. As of April 30, stronger than expected earnings had been reported by 87% of S&P 500 companies who had reported earnings, according to market data firm Refinitiv. Furthermore, companies are beating analyst expectations by more than usual. Rising earnings and earnings estimates have helped to cap forward price / earnings (P/E) ratios, a measure of market valuation. The S&P 500’s forward P/E ratio has declined to 23 times 1-year forward earnings estimates, down from a peak in the past year of more than 27 times earnings in September.

Source: Wall Street Journal, Bloomberg

Recent News

A Dovish Federal Reserve

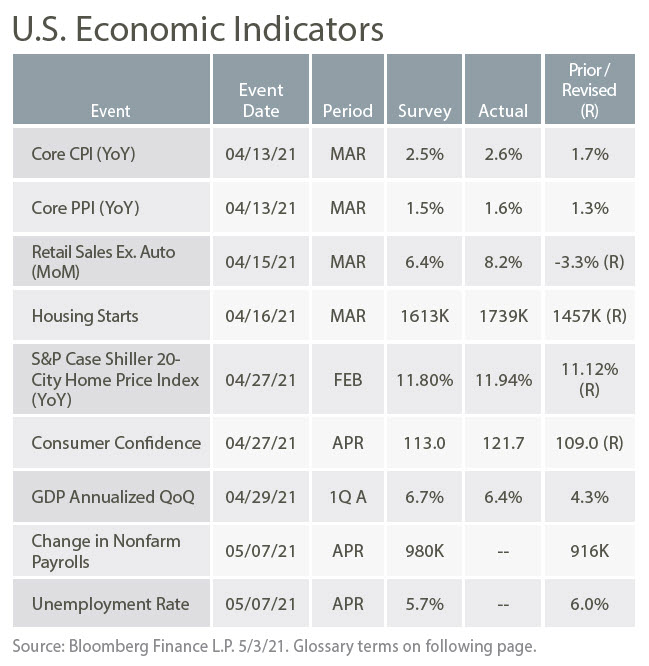

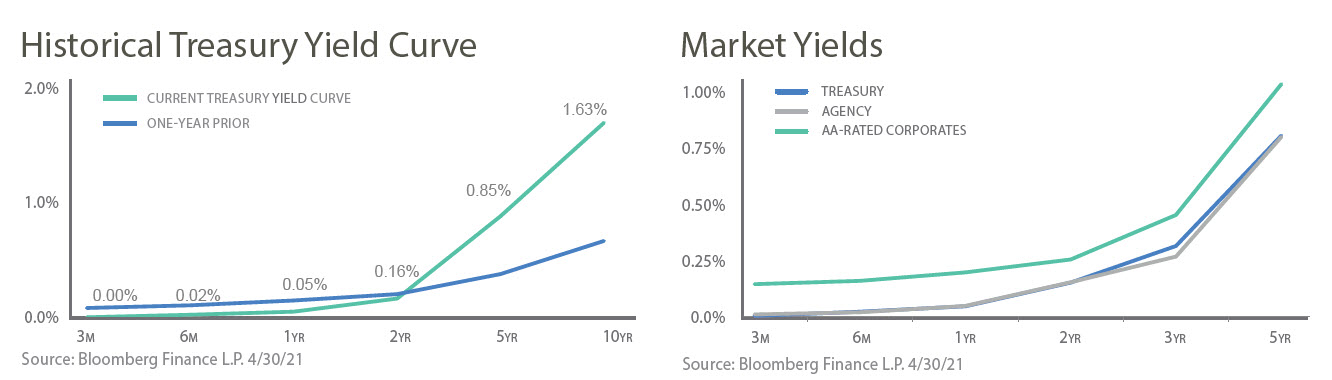

The Federal Reserve voted unanimously in its April meeting to hold the Fed Funds rate at near 0%. Fed officials reiterated that they will hold rates steady until the labor market is back to full strength and inflation has reached the central bank’s goal of averaging 2%. The Fed believes the recent uptick in inflation and projections for a near term rise are transitory in nature, largely reflecting very low year-over-year comparisons when energy prices fell sharply. While acknowledging economic improvement, Fed Chairman Jerome Powell said at a news conference following the Fed’s meeting that the recovery “remains uneven and far from complete.”

Source: Bloomberg