Featured Market Data

GDP and the Fed

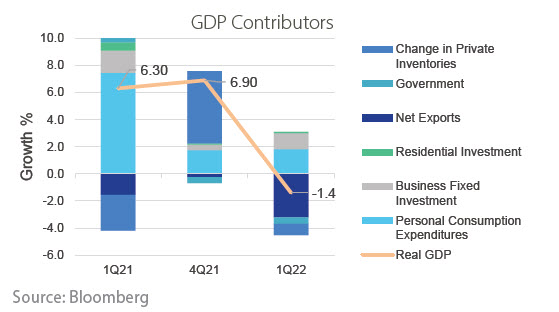

While the 1.4% decline in U.S. Real Gross Domestic Product (GDP) for the first quarter was a sharp reversal in growth trend, the underlying components display a much stronger picture. Private demand, including spending by U.S. consumers and businesses, grew at a 3.7% annual rate. Consumer spending accelerated to a 2.7% annual growth rate and business spending surged to 9.2%. Higher imports, lower exports, declines in inventory and lower government growth all contributed to the negative GDP. The GDP report is unlikely to change the Federal Reserve’s plans to raise interest rates rapidly this year. The Fed will likely see the stronger domestic growth details and firm labor market as reasons to remain hawkish on inflation.

Source: Wall Street Journal, Bloomberg

Recent News

Market Pain

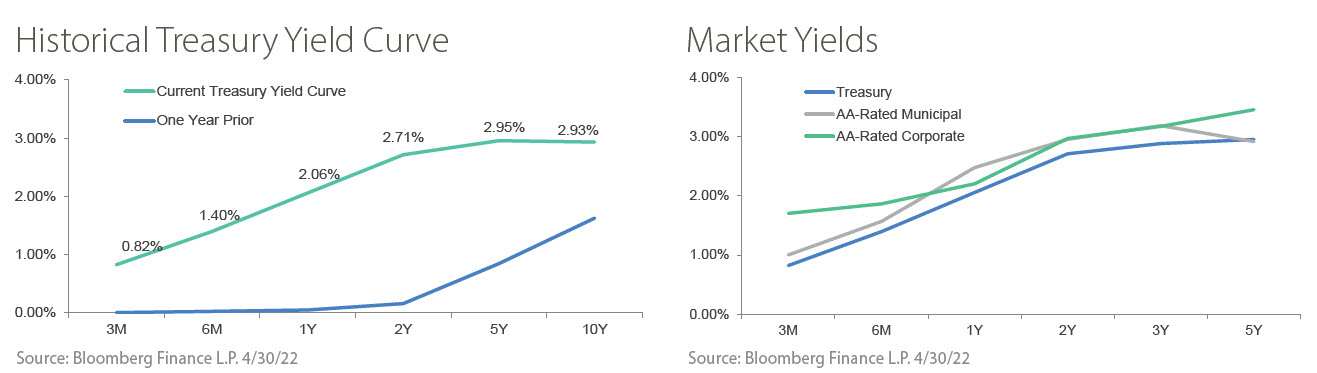

Stocks and bonds experienced substantial price pressure in April. The biggest headwind came from the velocity and magnitude of the rise in bond yields as the Fed projected a more aggressive policy shift. In fixed income, the Bloomberg U.S. Aggregate index was down 3.80% for the month. U.S. equities declined even more with the S&P 500, NASDAQ and Russell 2000 indices down 8.80%, 13.26% and 9.95%, respectively. In addition to the backup in rates, tighter financial conditions, bouts of curve inversion, negative real wage growth, dollar strength, and China’s zero-tolerance approach to Covid and related lockdowns all served as bearish talking points.

Source: FactSet