Featured Market Data

Fed Nearing End of Hikes

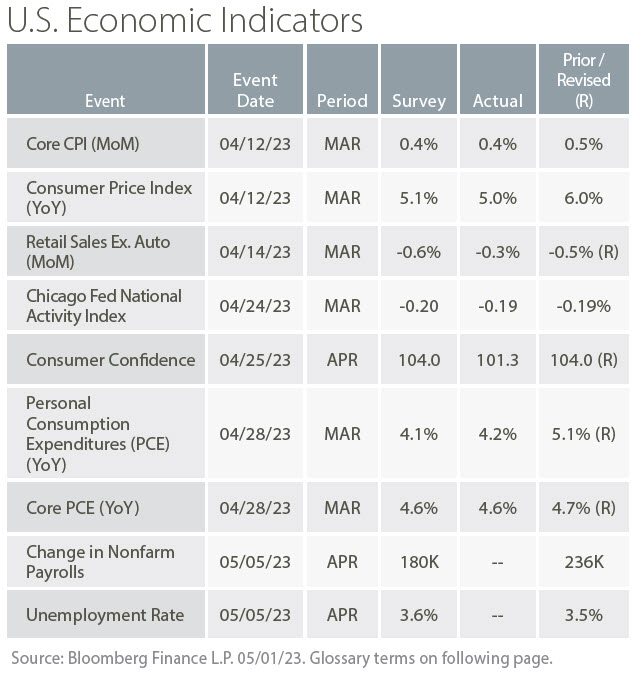

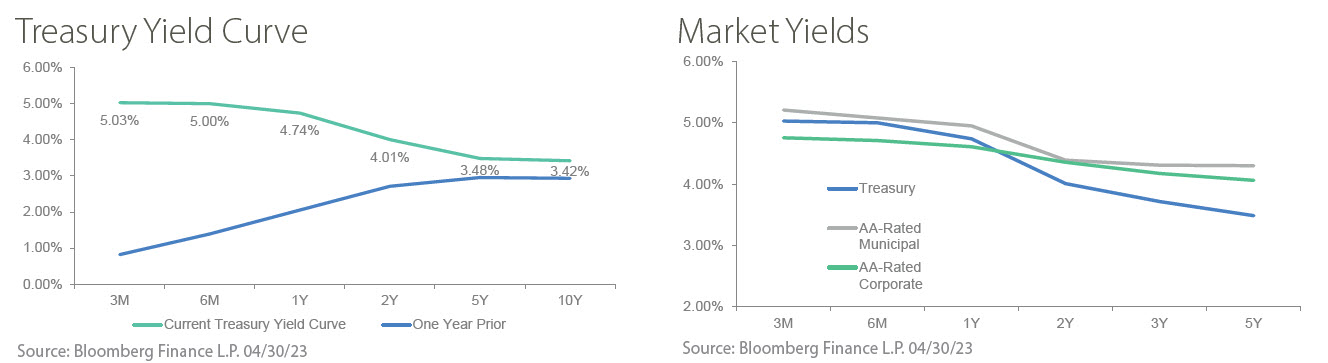

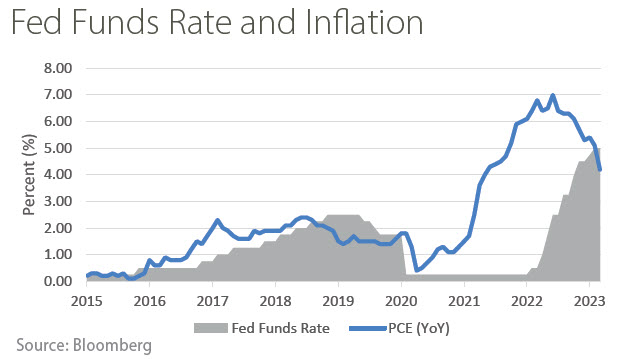

The “dot plots” released by the Fed in March depicted their plans to hike rates one more time this year and then hold rates steady. The Fed has also stated they remain data dependent and thus Personal Consumption Expenditures (PCE), the Fed’s preferred measure of inflation, is an important data point. By this measure, inflation slowed to 4.2% in March. This level is below the upper bound of the targeted fed funds rate of 5%, indicating the Fed is near the end of its rate hiking cycle. Looking forward, we see economic growth as a key consideration for the Fed as they determine the path of monetary policy.

Source: Bloomberg

Recent News

U.S. GDP Growth Slows

The Commerce Department reported on April 27th that growth in U.S. Gross Domestic Product (GDP) slowed in the first quarter to 1.1% from 2.6% in the fourth quarter. There were some positive signs beneath the decline in the headline number. Consumer spending increased to 3.7% from 1% in the fourth quarter as spending on goods and services rose. This was the strongest growth in consumer spending since the second quarter of 2021. Decreases in inventories and housing and weak business spending contributed to lower GDP growth for the quarter.

Source: www.bea.gov, Wall Street Journal