Investment Advisory Services Featured Market Data

U.S. Economy Still Chugging Along

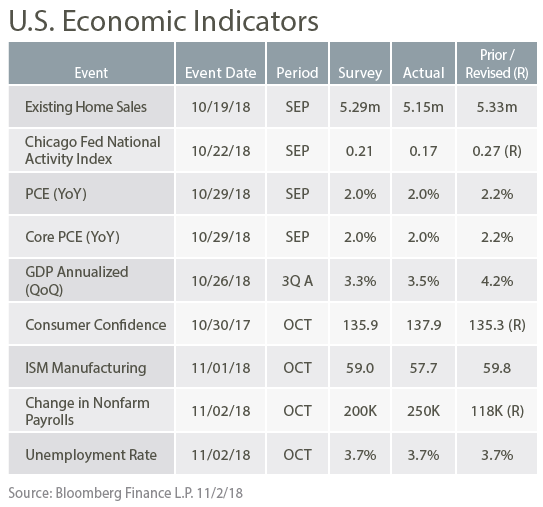

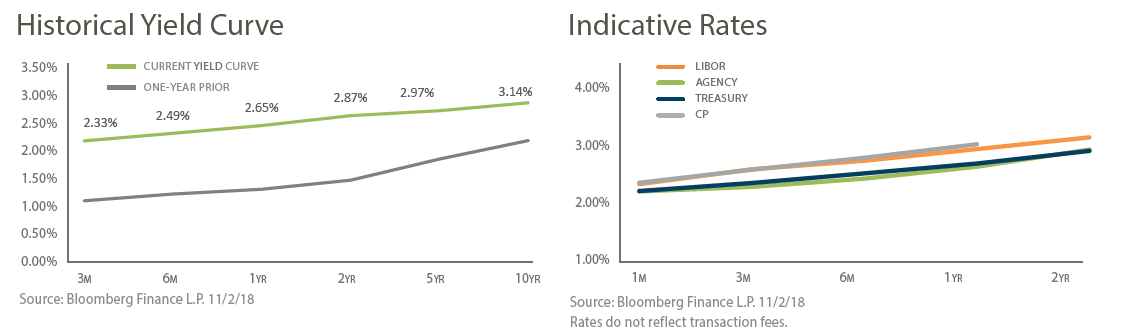

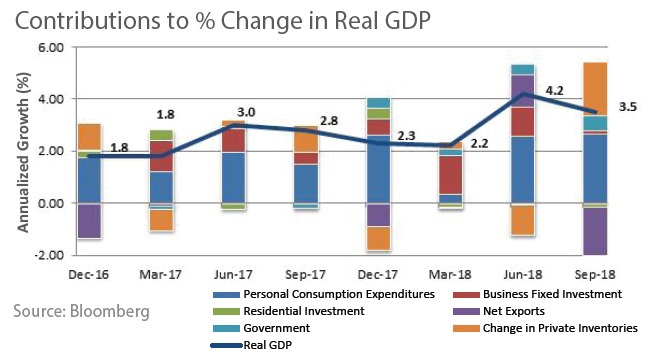

U.S. GDP growth remains solid with a reported 3.5% annualized growth rate during Q318 following a strong Q218 pace of 4.2%. Consumer spending and higher inventory levels contributed a substantial boost while lower net exports detracted from growth. Tax cuts continue to stimulate economic activity although we expect the impact to fade in upcoming quarters. While inflation remains moderate, we are monitoring inflation risks closely. The headline and core personal consumption expenditure indexes rose 2.0% in September. Given the economic backdrop, our expectation is for the Fed to increase rates again in December and once more in the first half of 2019.

Source: Bloomberg, Bureau of Economic Analysis

Investment Advisory Services Recent News

Market Volatility is Back!

Equity markets experienced increased volatility driven by investor concerns over rising rates, the possibility of higher inflation and increased trade tensions. The CBOE VIX index, representing volatility in the US equity, peaked at 27.8 on October 29th versus an average of 15.6 for 2018. For the month of October, the S&P 500 was down 6.8% but remains up 3.0% year to date. Global markets have experienced similar volatility, the Stoxx Europe 600 was down 5.5% and the Shanghai Composite fell nearly 8%. The recent market correction signals investors are recognizing risks associated with the end of loose global monetary policies, rising trade protectionism and slower global growth in the future.

Source: Bloomberg, Financial Times