Featured Market Data

Markets Loathe Uncertainty

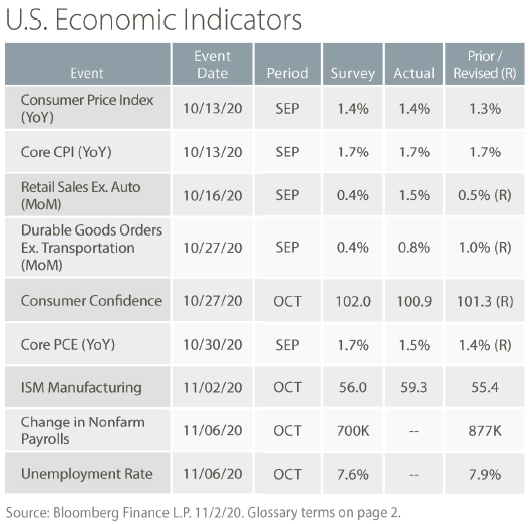

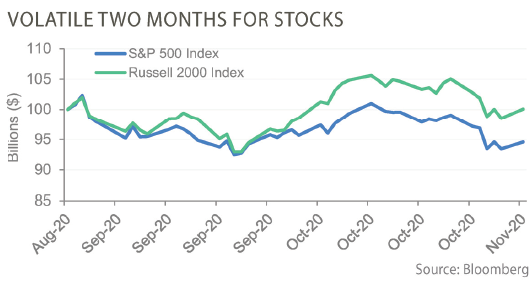

U.S. stocks as measured by the S&P 500 index declined for the second consecutive month in October. Market volatility has been heightened based on rising COVID-19 cases domestically and abroad, negotiations for additional fiscal stimulus, and uncertainty surrounding the U.S. election. The S&P 500 declined 3.80% and 2.66% in September and October, respectively. The largest question regarding the election is the timing of its conclusion, though the outcomes in Senate races will also impact policy and markets. In the event that markets become stressed in the coming days and weeks, the Fed remains well-equipped to provide markets with additional support and liquidity. We also believe a new fiscal stimulus package is likely regardless of the election outcome.

Recent News

Stocks and Bonds Down in October

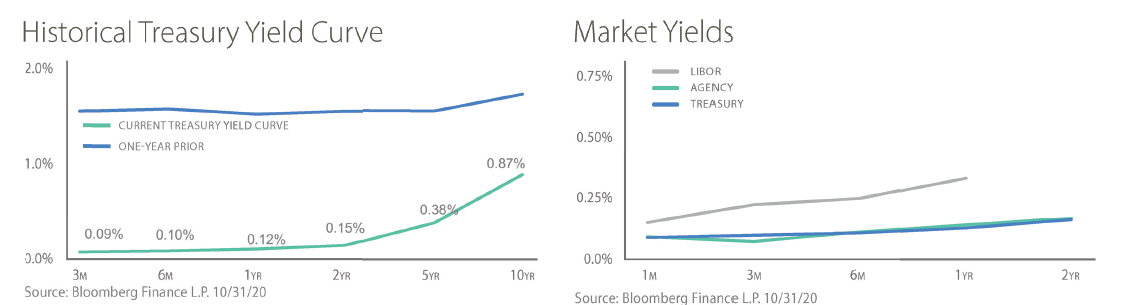

Stock and bond prices both declined in October. Typically, these asset classes move in opposite directions, but in periods of volatility, we have seen markets behave in an unexpected manner. If taken at face value, these market moves may be foreshadowing near-term risks for earnings and a brighter economic outlook in future years. The yield on the 10-year US Treasury increased 19 basis points in October, which normally indicates stronger expectations for future economic growth rates. Small cap stocks, as represented by the Russell 2000 index, represented a bright spot in equity markets for the month.

Source: Bloomberg