Featured Market Data

Fed Expectations Pulled Forward

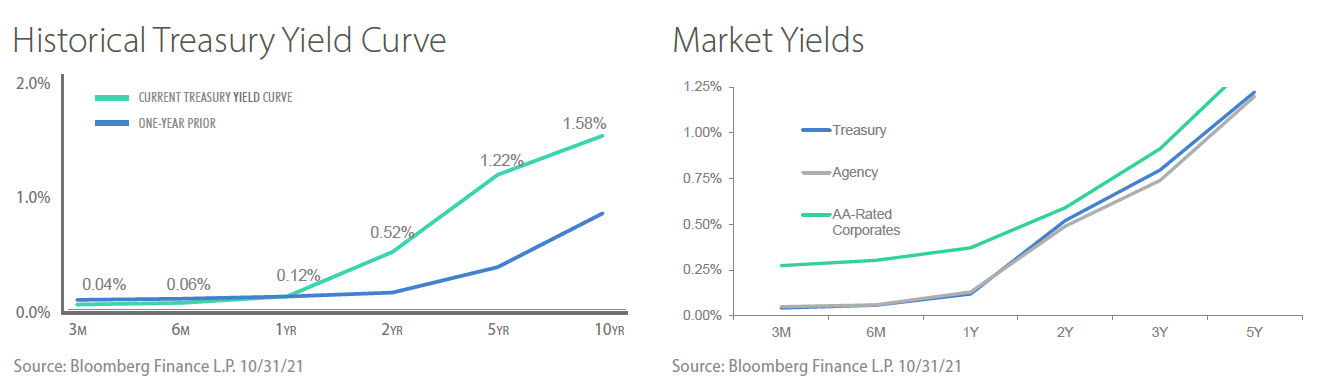

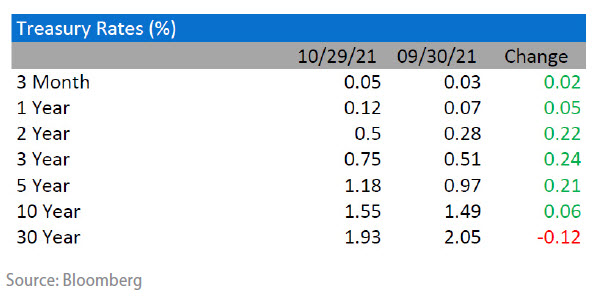

During October, markets priced in an earlier first rate hike by the Federal Reserve and a quicker initial path of hikes thereafter. Markets are pricing in at least two rate hikes in 2022 with the first in July. Rates in the 2-year to 5-year part of the Treasury yield curve rose abruptly as a result. Concerns about persistent inflation have pushed market expectations for higher policy rates ahead of the Fed’s projections. These more aggressive market expectations have flattened the Treasury yield curve. The decrease in the 30-year bond yield is an important signal. The market sees a more aggressive Fed as reducing long-term inflation.

Source: Bloomberg

Recent News

Equity Markets Rally

U.S. equities were higher in October, with the S&P 500 more than erasing its September slide and recording its strongest monthly return for the year. The Dow, S&P, and Nasdaq all ended October at record highs. U.S. third quarter GDP came in below expectations in the final week of the month, but markets had little reaction to this backward looking measure. Instead, third quarter earnings dominated markets. As expected, many companies referenced supply chain issues, input cost pressures and tight labor markets. At the same time, many companies pointed to higher demand, which helped support margins. Companies also discussed ongoing efforts to moderate supply chain challenges.