Featured Market Data

Earnings Forecasts Down

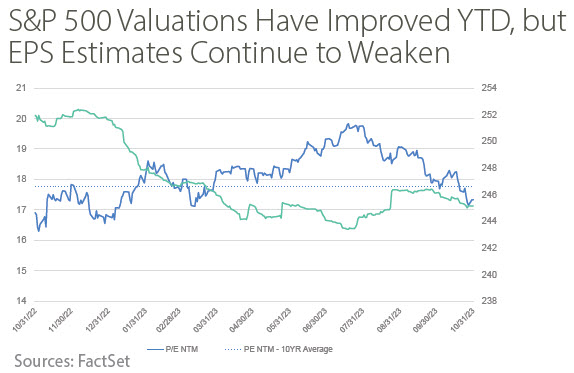

More than 55% of S&P 500 companies reported third quarter earnings through October 31st, with the blended (actual plus estimates) earnings growth rate of 2.8% outpacing expectations for a decline of 0.3%. However, the magnitude of positive earnings surprises has so far run below five-year averages. Another trend in the third quarter is the slower blended year-over-year revenue growth rate of 2.1% compared to the 10-year average of 5.0%. Weaker revenue growth has placed concern on consumer resilience and demand. Slower revenue growth and weaker fourth quarter company earnings guidance have contributed to analysts’ lower 2024 earnings estimates during this earnings season.

Source: FactSet

Recent News

Fed Holds Rates

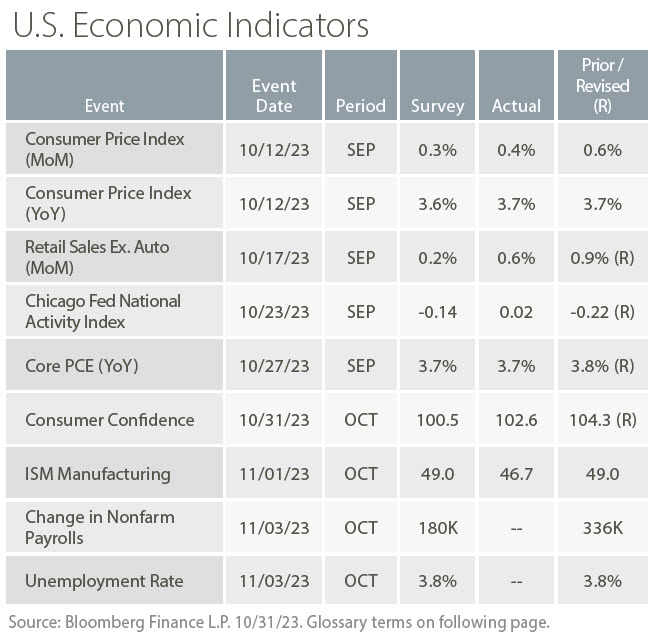

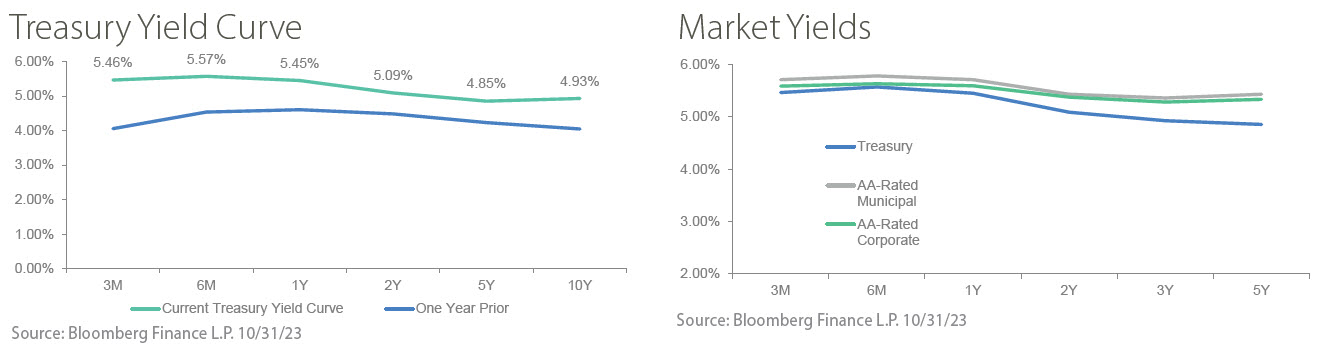

The Fed held rates steady on November 1st despite continued strong growth and employment and persistently elevated inflation. Real gross domestic product (GDP) increased in the third quarter at an annual rate of 4.9% according to the “advance” estimate. A strong consumer helped fuel this growth. Unemployment remained very low at 3.8% in September and headline CPI continued its above target growth at 3.7% in September. In holding rates steady, the Fed recognizes the cumulative effects of tighter monetary policy and the lagging impact of higher rates on growth and inflation. As such, rather than raising rates, the Fed is emphasizing that current policy is restrictive and they intend to remain restrictive as long as necessary.

Source: Bloomberg