Investment Advisory Services Featured Market Data

Will U.S. Stocks Continue to Rally?

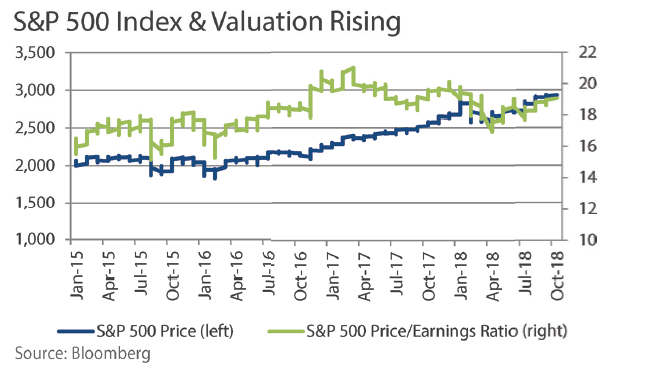

U.S. stocks rallied in the 3rd quarter on strong growth and continued optimism. Meanwhile, U.S. stock market valuations (the price / earnings ratio) have been on the rise since April. This contrasts to other major markets in Europe and Asia where growth has been slower. Year-to-date, the S&P 500 is up over 9%, while the Stoxx Europe 600 is down about 1% and the Shanghai Composite has fallen nearly 15%. As a result, U.S. stocks have become increasingly expensive compared with major world indexes. In addition to higher valuations, some analysts have noted that recent U.S. stock market growth has been driven by defensive (high quality) stocks, signaling increased caution by investors in U.S. stocks.

Source: Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

Fed Hikes Rates for Eighth Time

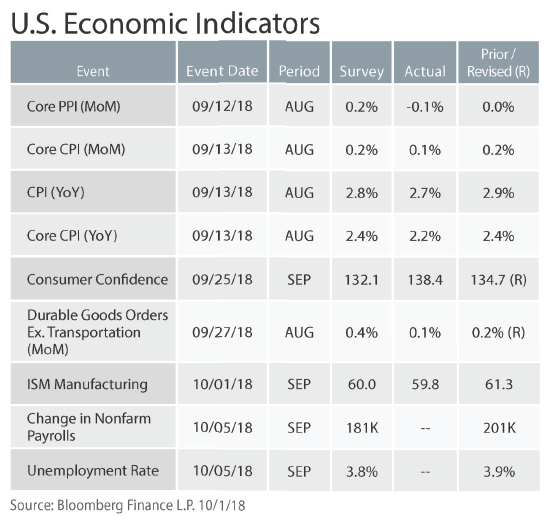

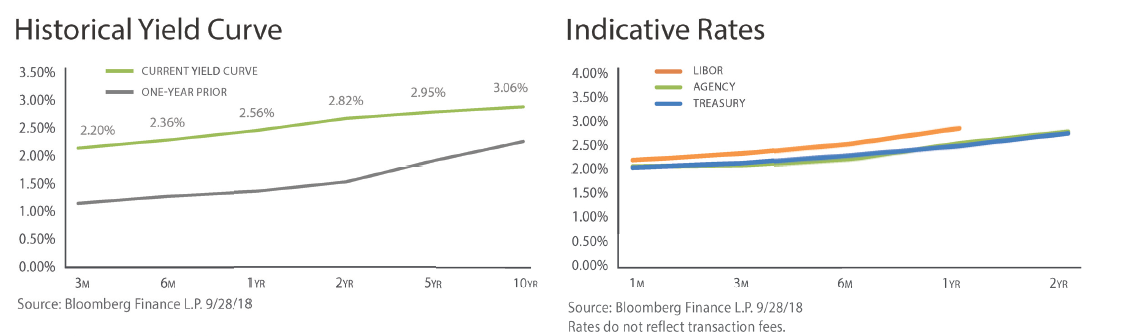

The Federal Reserve raised interest rates for a third time and signaled a fourth increase this year is likely. The median forecast calls for 3 more hikes next year. Fed Chairman Jay Powell noted that healthy growth and low unemployment and inflation are “very good signs.” The Chairman also noted during a press conference that while companies have expressed concerns about trade and the Fed is watching closely, any impact on economic performance is hard to discern. Economic projections released by Fed members at the September meeting show slight increases in projected GDP growth in 2018 and 2019 and inflation projections for 2019 were steady at 2.1%.

Source: Bloomberg, Financial Times