Featured Market Data

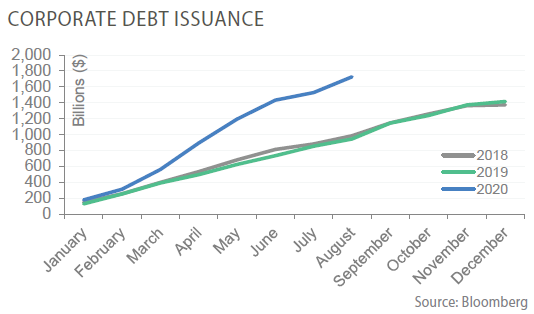

Corporate Bond Issuance Surges

U.S. companies issued more debt through the first 8 months of 2020 than in all of 2019 and total outstanding debt sits at record highs. A recent Moody’s report focused on the lengthening maturities of newly issued debt at historically low yields and concluded this enhances financial flexibility. However, the same report also noted that the recent debt issuance boom limits future borrowing. As prudent investors, we believe strong balance sheet management is crucial to maintaining healthy credit quality. Indeed, terming out debt is preferred over more volatile short-term debt, but capital structure also requires sufficient equity. Higher leverage may reduce companies’ future ability to borrow which could have negative impacts on company balance sheets as well as economic growth.

Source: Moody’s Analytics, PMA Asset Management, www.sifma.org

Recent News

Stock Volatility Rises

U.S. stocks were broadly lower in September with notable weakness in the large-cap technology sector, which had been a strong performer this year. Nonetheless, the S&P 500 reported an 8.5% gain in the 3rd quarter despite a loss of nearly 4% in September. Meanwhile, the VIX, a measure of stock market volatility also increased in September. Volatility is expected to remain high through the Fall and the risk of a disputed U.S. presidential election has caused a spike in VIX futures around the November vote.

Source: Bloomberg