Featured Market Data

Seeking Income

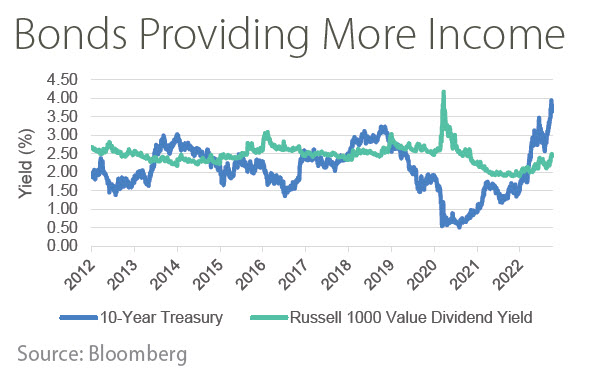

A plummet in bond yields in 2020 sent many investors on a search for yield. A relatively attractive dividend yield on stocks provided one source of income. As investors gravitated toward dividend paying stocks, equity indices such as the Russell 1000 Value index outperformed more growth oriented indices. The yield advantage for stocks has abruptly reversed in 2022 with the yield on 10-year Treasury notes approaching 4% in September. The dividend yield on the Russell 1000 Value index, meanwhile, is less than 2.5%. Higher bond yields are attracting yield hungry investors and reducing price support for stocks that may have benefited from providing greater income over the prior two years.

Source: Bloomberg

Recent News

Central Banks Going Too Far?

Central banks around the world are raising interest rates swiftly to slow inflation. The cumulative effect is creating concern for some economists, including those at the World Bank, that rates may rise too high, too fast. To avoid an unnecessarily deep economic downturn, the World Bank advised policy makers to “take into account the potential spill overs of globally synchronous domestic policies.” In the U.S., futures markets indicate the Federal Reserve will take heed of this advice. While the latest “dot plots” from the Federal Reserve’s September meeting show a median fed funds rate of 4.625% at the end of 2023, the futures market points to a lower level of 4.12%.

Source: Wall Street Journal