Featured Market Data

Why are Treasury Yields Rising?

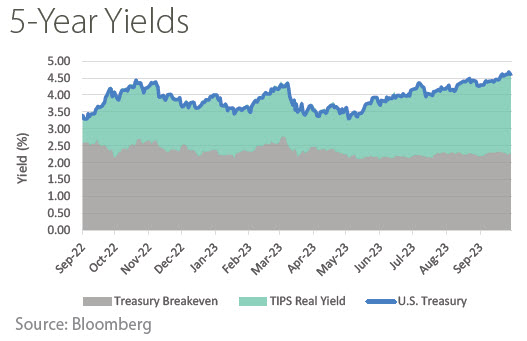

The 5-Year U.S. Treasury yield rose about 0.35% in September. Inflation expectations, as represented by the Break even yield, rose only 0.08%. The difference between these two measures is the Real yield on Treasury Inflation Protected Securities (TIPS). With inflation expectations gradually declining over the past year, there is another reason for the rise in Treasury yields. Higher Real yields may be caused by factors such as stronger economic growth expectations and term premium. Term premium is the extra yield investors demand for buying longer term securities. In the long period of near-zero interest rates, term premium was often negative. With growing expectations the Fed will keep rates higher for longer, we may see a further rise in Treasury yields.

Source: Wall Street Journal, Bloomberg

Recent News

Market Sentiment Turns Negative

Market sentiment turned more downbeat in September. The AAII Sentiment Survey offers insight into the opinions of individual investors about where the market is heading in the next six months. According to this survey, bullish sentiment fell to 27.8% and bearish sentiment rose to 40.9%. The month brought numerous bearish talking points including higher Treasury yields, the UAW strike and weakness in China’s property sector as U.S. stock prices declined. History has shown when sentiment declines sufficiently, it can be followed by a stock market rally. For example, sentiment was somewhat weaker than current levels this spring in advance of a summer rally.

Source: FactSet, www.aaii.com