Investment Advisory Services Featured Market Data

Bond Market Volatility

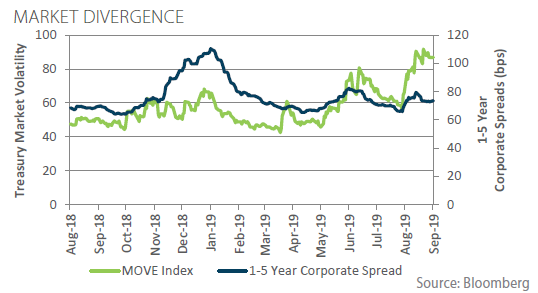

U.S. Treasury market experienced a surge in volatility in August as displayed by the Merrill Lynch MOVE Index. Despite this volatility, corporate spreads widened only modestly. The chart below shows that when market volatility increased in the 4th quarter of 2018, yields on 1-5 year corporate bonds widened to more than 100 basis points above similar dated Treasuries. Such widening in spreads is expected when uncertainty increases. The fact that news driving Treasury prices down occurred in August, a time of normally light trading activity, is a likely contributor to this divergence. Technical factors related to trading strategies also might have exacerbated the decrease in Treasury prices. Regardless of the cause, we expect market volatility to remain high as we continue into the Fall.

Source: Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

What is the Fed to Do?

Minutes of the July 30-31 Federal Open Market Committee characterized the rate cut as a “recalibration of the stance of policy, or mid-cycle adjustment.” However, minutes also showed officials are divided about what steps to take. Several officials favored holding rates steady based on good economic conditions. Two officials, however, favored a more aggressive half-point cut, which they said would better address “stubbornly low” inflation. Following the release of the minutes, markets priced in a smaller chance of a half-point cut in September. Since then, weaker data and growing trade uncertainty have pushed those chances to near 23 percent.

Source: www.federalreserve.gov