Featured Market Data

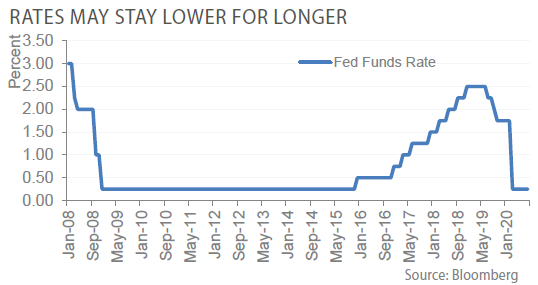

New Fed Policy Addresses Low Inflation

Faced with lower current inflation and inflation expectations, the Federal Reserve announced changes to its monetary policy strategy in August. This shift in policy lessens the Fed’s practice of preemptively raising rates to avoid higher inflation and will likely lead to lower rates for longer. Following high inflation of the 1970’s, the Fed worried that waiting too long to raise rates could lead to price pressure. Over the past decade, interest rates and inflation have been suppressed by factors such as demographics, globalization and technology. Federal Reserve Chairman Jerome Powell said the policy change reflects the Fed’s view that a “robust job market can be sustained without causing an outbreak of inflation.” The Fed now seeks a strong labor market and inflation that “averages 2 percent over time.”

Recent News

What is Driving Stock Prices?

U.S. stocks continued to rally for the fifth straight month as the S&P 500 hit a record high in late August and increased 56% since March 23rd. Stocks on the S&P 500 are now trading at a multiple of 24 times forward earnings, which are Wall Street’s expectations for companies’ earnings over the next 12 months. Over the past 20 years this multiple has averaged a much lower 16 times forward earnings. Market observers continue to credit massive monetary and fiscal stimulus for the gains. In particular, the CARES Act provided stimulus checks, expanded unemployment benefits, and allowed for mortgage forbearance. However, with no fifth relief package approved, lower payrolls and renewed mortgage payments may reverse recent trends giving way to more volatility in coming months.

Source: Bloomberg, PMA Asset Management