Featured Market Data

Economic Growth Propels Stocks

Strong economic data helped lift the S&P 500 by 5.17% in February as markets also priced in a Federal Reserve that may be slower to cut rates. The Citi Surprise Index, which compares forecasted economic data to reported data, rose in early February on higher employment and inflation data. While economic data cooled later in the month, strong earnings for publicly traded companies, including excitement around Nvidia’s earnings and artificial intelligence more broadly, also contributed to higher stock prices. Small cap stocks also performed well in February.

Source: Bloomberg

Recent News

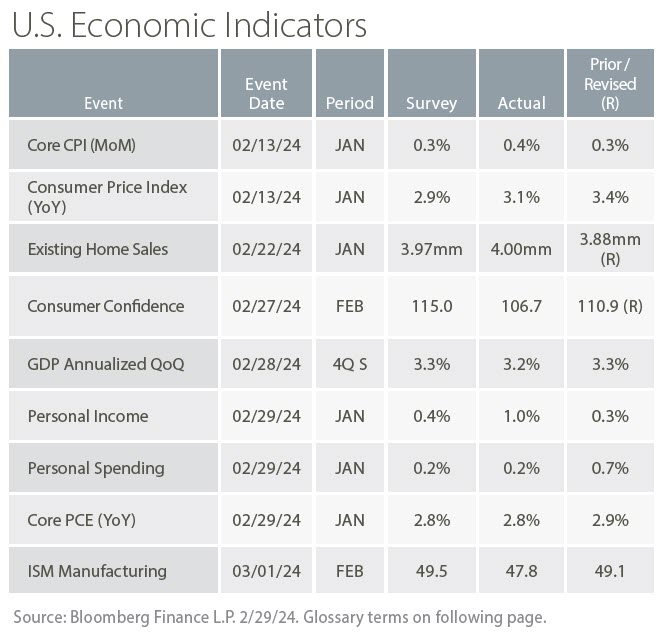

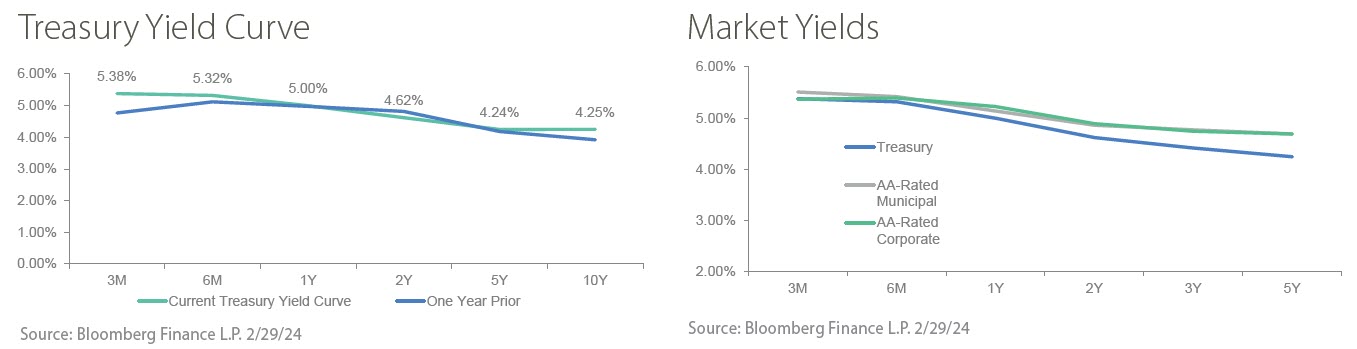

Treasury Yields Rise

A higher than expected CPI report contributed to a shift back in market expectations for when the Fed will first cut rates. While some analysts have attributed the higher CPI to seasonal factors, other strong economic data further supported expectations for fewer Fed rate cuts in 2024. The market had priced in rate cuts as soon as March, but those expectations are now mostly priced in for June with three 2024 rate cuts priced into markets. Treasury yields moved higher as expectations evolved. The 2-year U.S. Treasury yield rose 41 basis points to 4.62% at the end of February. The 10-year also advanced 34 basis points to 4.25%.

Source: Bloomberg