Investment Advisory Services Featured Market Data

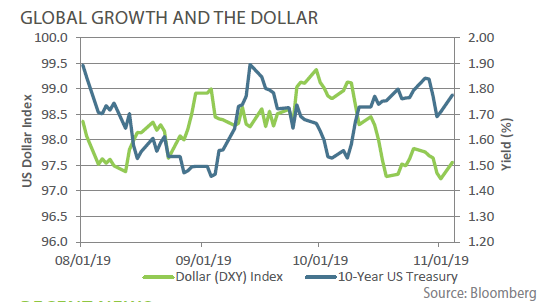

What is Moving the Dollar?

Over the past year, President Trump has repeatedly blamed the Federal Reserve for setting rates too high and strengthening the US dollar. The strong dollar makes foreign goods less expensive and puts downward pressure on the price of goods manufactured in the U.S. This can negatively impact U.S. manufacturers. However, data over the past several months suggests that President Trump’s trade policy is having a large impact on the dollar. In August, when trade fears rose, there was a flight to quality which pushed Treasury yields lower and the dollar higher. Greater optimism around trade in October pushed US yields up and weakened the dollar.

Source: Bloomberg

Investment Advisory Services Recent News

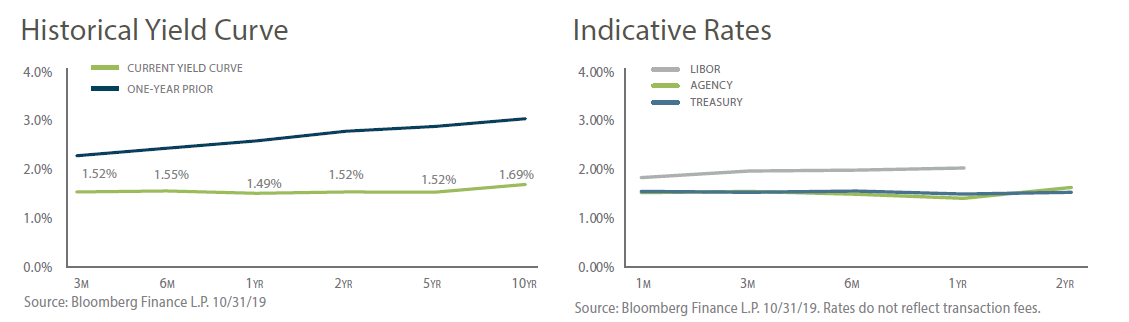

A Hawkish Cut by the Fed

As expected, the Fed cut interest rates in October by 25 basis points to a range of 1.50-1.75%. Fed Chairman Jerome Powell made it clear that only a “material reassessment” of the economic outlook would provoke further action. This is a strong signal that the bias is not as skewed toward additional future easing. While we have heard that message before, as recently as the September Fed meeting, better economic data and more agreement at the Fed suggests this time might be different. Both equities and US Treasuries rallied slightly following the announcement. Nonetheless, we would expect more volatility in the weeks ahead as trade policy continues to influence markets and the Fed.